Most people know QuickBooks as a tool for managing your business finances. But did you know you could potentially use it to manage your personal finances as well? QuickBooks is a widely recognized and trusted accounting software developed by Intuit to help businesses better understand their finances. It is designed to help businesses efficiently managing their financial transactions, including their income, expenses, invoicing, and reporting. With its user-friendly interface and comprehensive features, may see it as the go-to solution for all their business needs. With its reputation, the question still stands, can you use QuickBooks for Business and Personal?

As you see how robust QuickBooks can be at streamlining your business finances, a common question arises: “Can I use QuickBooks for both my business and personal finances?” This question comes from the convenience and familiarity that QuickBooks offers for business accounting, leading some users to wonder if it can be extended to handle their personal financial matters as well.

Well in short, the answer is yes, QuickBooks can be used for both business and personal. However, caution must be used when using it for personal as this is not its primary function.

In this blog post, we will dive into the pros and cons of using QuickBooks for both business and personal finances. We will explore the functionalities of QuickBooks, its benefits for business financial management, and how it can be used for personal as well. Additionally, we will highlight best practices for effectively using QuickBooks in this dual capacity and address any potential concerns that may arise from combining business and personal transactions. Whether you’re a small business owner, a freelancer, or someone seeking efficient personal finance management, this article aims to provide you with valuable insights to make an informed decision about utilizing QuickBooks for your unique financial needs. Let’s get started.

Understanding QuickBooks

Before you can determine if you should use QuickBooks for business and personal, it is important to understand what QuickBooks has to offer.

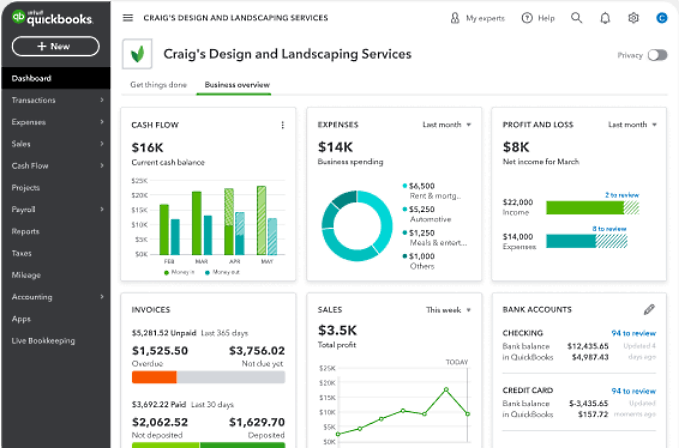

QuickBooks has many features to help you manage your finances. Here are some of the most popular and well known things QuickBooks can do for your business:

QuickBooks is a powerful accounting software developed by Intuit that offers a wide range of features and functionalities to streamline financial management for businesses. Some of the key features include:

- Bookkeeping: This is the main feature of QuickBooks. Bookkeeping encompasses many things but to simplify things, it allows users to record and categorize income (money you earn) and expenses (money you spend). A cool feature is that QuickBooks can connect to your bank account directly, pull transactions from it in realtime so that you can categorize them.

- Invoicing and Payments: With QuickBooks you can create professional invoices and receive payments directly through the software. This is a convenient way for businesses to settle transactions with clients or customers.

- Expense Tracking: Users can use the software to track expenses, including receipts and bills, and automatically categorizes them. You can import your receipts directly into the software to categorize later.

- Financial Reporting: QuickBooks can generate a variety of financial reports, such as profit and loss statements, balance sheets, and cash flow statements. These reports provide valuable insights into your company’s financial health.

- Payroll Management: For those that have employees, QuickBooks also offers payroll services that help businesses manage employee salaries, taxes, and deductions efficiently.

- Inventory Tracking: For businesses dealing with inventory, QuickBooks provides tools to monitor stock levels, track product sales, and generate inventory reports.

As you can see QuickBooks has many features that will help you professionally and personally. However, understanding how these features are used is crucially to achieving the best experience in both worlds.

It should also be noted that QuickBooks comes in a software and an online version. Depending on your needs, one may be more suitable than the other. If you need to use QuickBooks for business and personal use, picking the right one will save you a lot of headache down the road. This is because some of the features mentioned above maybe available in one version and not the other.

Let’s now look at the different QuickBooks softwares and how each can be used for business and personal use.

Versions of QuickBooks For Business and Personal Use

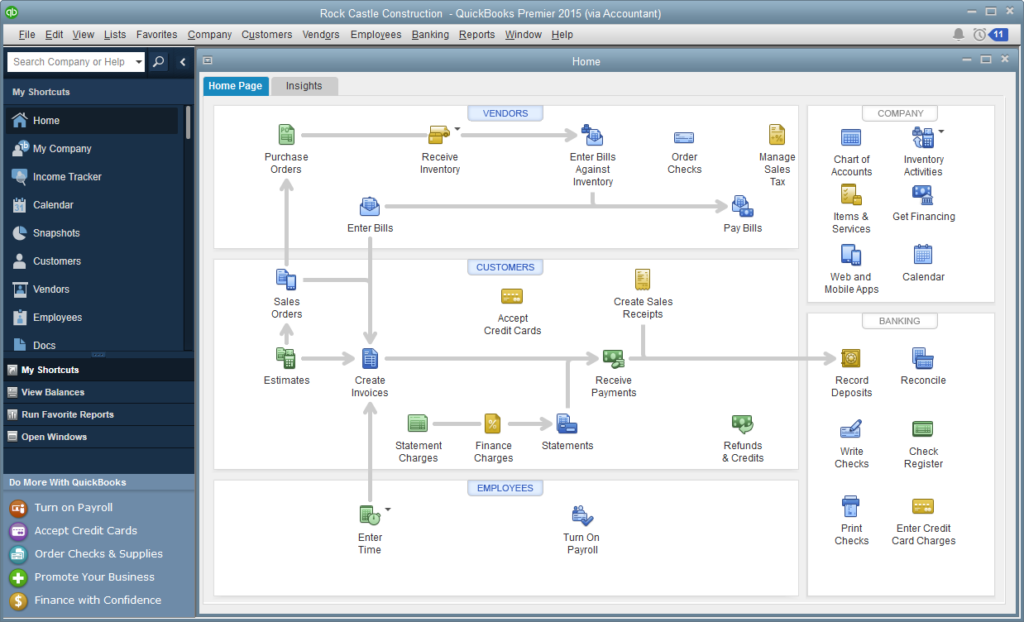

QuickBooks is available in two primary versions: QuickBooks Online (QBO) and QuickBooks Desktop. Each version comes with its own set of features and advantages, catering to different user preferences and business needs.

QuickBooks Online (QBO)

- Cloud-Based: QBO is web-based, allowing users to access their financial data from any device with an internet connection.

- Automatic Backups: Data is automatically backed up on Intuit’s secure servers, reducing the risk of data loss.

- Scalability: QBO offers different subscription plans, making it suitable for businesses of all sizes.

QuickBooks Desktop

- Locally Installed: QuickBooks Desktop is installed on a specific computer, providing offline access to financial data.

- Customization: Desktop version allows more extensive customization options to meet specific business needs.

- Advanced Features: Some advanced features, like industry-specific versions, are only available in QuickBooks Desktop.

Ultimately, if you need versatility, automation, expert help, simplicity, mobility, and, scalability, then QuickBooks Online may be the best option. This is regardless of whether you want to use it for business or personal. QuickBooks Desktop on the other hand requires a bit more skill and understanding to use and may not be well suited for personal use.

Now that you understand the best QuickBooks software to use for personal or business use, let’s look at how we can use the software for business or personal finances.

How to Use QuickBooks for Business and Personal Use

So, to ask the question again – can QuickBooks be used for business and personal use? The answer is yes, you can use QuickBooks for business and personal. However, you need to have two separate QuickBooks accounts to accomplish this – one for business and one for personal. It is never recommended to combine your personal and business finances into one QuickBooks account as this can result in poor and skewed financial reporting.

In this section, we will discuss how to use QuickBooks for business and how to use it personal.

How to Use QuickBooks for Business Alone

If you have a business, QuickBooks can be vital in streamlining and simplifying your finances. Its user-friendly interface and robust features make it an ideal choice for entrepreneurs and small business owners. By centralizing financial data and automating various tasks, QuickBooks allows businesses to save time and improve overall efficiency.

While most business owners are not accountants or bookkeepers, it is important to note that although QuickBooks is fairly simple to use, it is made for accountants and bookkeepers. Hence, basic knowledge of accounting is a must in using the software to its full capacity.

In the following, we will discuss steps to take to setup QuickBooks for business finances

Step 1: Get a QuickBooks Account

QuickBooks comes in various forms. These include: EasyStart, Essential, Plus, or Advanced. All of these have their pros and cons. The EasyStart is the most basic version (for online users). It has everything you need to run your business except for: tracking inventory, managing bills and payments, multicurrency, and the ability to add users. These exceptions are including for higher plans however.

As a business owner, you want to choose a plan that fits your business needs. Check out the full list of plans here.

Step 2: Configure QuickBooks Settings

After you choose a QuickBooks plan and create an account, you want to first go through the setting and make sure the correct options are chosen for your business. Failure to do this before using the software, may create incurate reports for your business when you start to use the software.

The settings can be accessed by using the Gear Icon at the top right corner of your QuickBooks software.

Step 3: Set Up Your Chart of Accounts

These accounts are going to be used to help you categorize the transactions that come from your bank feeds. It is important to use the correct configurations when setting up your chart of accounts as these will be used in creating reports for your business. Failure to use the correct configuration will result in inaccurate reporting.

Step 4: Connect Your Business Bank Accounts to QuickBooks

This is an important step towards making QuickBooks more automated. QuickBooks allows you connect most popular financial institution to pull bank feeds into the software automatically. Once the feeds are pulled, you can categorize your transactions using the categories you set up in your chart of accounts.

Adding a bank account is super easy. Simply click “Link Account” after clicking the Banking menu on your left. After that, follow the prompts that follow. You will be asked to sign into your bank account. This is a normal procedure. The software is unidirectional and pull only read only version of your bank statements.

Step 5: Start Using the Software

Once you have setup your software for business use, you can start using it. Usage of the software typically means categorizing the bank feeds to the right category, creating and sending invoices, running financials reports, and creating bill or expenses.

If you need help using this tool or if you require an account to fully manage the software, consult with us here.

How to Use QuickBooks for Personal Alone

Using QuickBooks for personal, is similar to using it for business. The only difference is that you will use less features than you would for business. As previously notes, the software is made for businesses and it is best used for businesses so a basic understanding is still required to use it personally.

If you plan on using the software for personal alone, the steps are very similar to using it for business use. Here is how to properly using QuickBooks for personal use.

Step 1: Get a QuickBooks Account

Follow the same steps 1 – 4 in getting your QuickBooks account, settings and chart of accounts setup.

If you are using QuickBooks for personal alone, you have to still set it up in the same way as you would as if your personal income and expenses were a business.

Step 2: Start Using the Software

Using the software for personal use may be a bit different from using it for business use. For personal use, you may only focus on categorizing transaction in the bank section. If you are an employee you will see most of your income come in your bank feeds so there is no need to using the invoice feature.

You will however look to us the bill feature to record and track personal bills that you wish to pay later. Otherwise, most of your expense will be show in your bank feed and only need to be categorized. As with the business use, you can also generate reports to give you an accurate understanding of your income as it compares to your expense.

This is a great way to see if you are indeed living within your means and how much you can save on a monthly basis.

Can You Use One QuickBooks Account for Business and Personal?

Although it is best practice to keep personal finances separate from business, some may insist on combining the two and tracking it in one QuickBooks account. This requires careful planning to prevent confusion and maintain accurate financial records but it is definitely possible.

Here are the steps required to use one QuickBooks account for business and personal use:

Step 1: Setting up QuickBooks for Business and Personal Use

Follow steps 1 – 2 of using QuickBooks for business alone.

Step 2: Create Separate Accounts and Categories

When you start setting up your chart of account, you want to set up distinct accounts for business and personal finances. This ensures clear segregation of funds and expenses. This will be important later when you run financial reports and want to clearly see the two. Create separate categories for income and expenses for each aspect to accurately track transactions.

Step 3: Connect Bank and Credit Card Accounts

Link your business and personal bank accounts and credit cards to QuickBooks. In doing so, make sure to connect the appropriate accounts to the correct aspect (business or personal) within the software.

If you have existing business and personal financial data, you can also import it into QuickBooks. Ensure that transactions are mapped correctly to the relevant accounts and categories.

Step 4: Implement User Access Controls

Since you are using QuickBooks for personal usage, it is important set up user permissions to limit access to sensitive personal financial information. Assign roles and permissions based on each user’s responsibilities and needs.

Step 5: Start Using the Software

Follow the same steps as you would for using the software for business and personal use alone. This time, make sure to clearly distinguish the difference between personal and business use.

Step 6: Seek Professional Advice

Lastly, consult with an accountant or financial advisor to ensure compliance with tax regulations and best practices when managing both business and personal finances within QuickBooks. They can provide guidance on setting up the accounts correctly and offer insights into optimizing financial management.

If you need help navigating this process, you can consult with our experts here.

Remember, while using one QuickBooks account for business and personal use can offer convenience, it requires careful organization and diligence to avoid confusion and maintain accurate records. Keep a clear distinction between the two aspects to ensure that financial reporting remains accurate and reliable.

Pros and Cons of Using QuickBooks for Business and Personal Finances

Now that you know how to use QuickBooks for business and personal use, let’s now look at the pros and cons of doing so.

Pros

Centralized Financial Management

If you are looking to have everything in one place, then using one QuickBooks account to manage personal and business finances offers convenience and ease of access. In addition, it is a great way to streamline financial data and allows for a comprehensive view of overall financial health.

Familiarity and Ease of Use:

For individuals already using QuickBooks for their business, the transition to personal finances is very easy and seamless. This is because the familiarity with the interface and functionalities reduces the learning curve.

Potential Cost Savings Compared to Using Separate Platforms

Lastly, using a single platform for both purposes can result in cost savings on software subscriptions or licenses. Avoiding the need to use multiple accounts reduces training and software costs.

Cons

Mixing Business and Personal Transactions Can Be Confusing

In accounting, combining personal and business transactions is never a good idea. It can lead to inaccuracies and make tax reporting more complicated. Also, business-related reports may be affected by personal transactions which will impact financial analysis.

If your business requires a loan, it may be denied. This is because your personal expenses mixed with your business may skew and present inaccurate financial numbers.

Limited Customization for Personal Finance Needs:

QuickBooks is primarily designed for business accounting, and some personal finance features may be lacking. Personal finance-specific requirements such as tracking saving or investments accounts might not be fully met within the software.

Potential Security and Privacy Concerns:

Storing personal financial data in the same system as business data raises security risks. If the business involves multiple users, access control becomes crucial to prevent unauthorized access to personal information.

Conclusion to Using QuickBooks for Business and Personal

In this blog post, we delved into the question of whether you can use QuickBooks for both business and personal finances. We explored the features and functionalities of QuickBooks, its benefits for business financial management, and how it can be adapted for personal finance tracking.

Here were the key Points Discussed:

- QuickBooks is a powerful accounting software that offers robust tools for managing business finances, including tracking income, expenses, invoicing, and generating financial reports.

- It is possible to use QuickBooks for personal finances by creating separate accounts and categories, allowing users to track personal income, expenses, and even set budgets.

- Using QuickBooks for both purposes can provide centralized financial management and familiarity in handling transactions across different accounts.

- However, mixing business and personal finances in the same platform can lead to confusion and potential reporting discrepancies.

While QuickBooks offers convenience, it is crucial to exercise caution when using it for both business and personal finances. Mixing the two can blur the lines and create accounting complexities, leading to inaccurate financial reporting and potential tax implications. Before making a decision to use QuickBooks for business and personal use, take the time to assess your specific requirements. If you operate a small business with relatively straightforward financials, using QuickBooks for both may work well. However, for more complex business activities, it may be well served to separate both entities.