If you are a property manager or a landlord, your ability to track rental income accurately is crucial for your business success. QuickBooks Online (QBO) has been used by many property managers as a trusted source to record rental income, manage tenant payments, and track expenses, all from a single platform. However, if you’re new to QuickBooks Online or to property management accounting, you might be wondering where to start.

In this guide, we’ll walk you through 6 straightforward methods to record rental income in QuickBooks Online. Regardless of how you are receiving your rental imcome, you will be sure to find a solution of how to record it in this guide. You’ll learn when to use sales receipts, invoices, recurring transactions, and other features in QuickBooks Online to ensure that every payment is accurately recorded.

Using the right method keeps your bookkeeping neat and makes it easy to pull essential financial reports. Each of these methods come with their own pros and cons but the generally all produce the same result – recording rental income.

By the end of this guide, you’ll be equipped to choose the best way to track rental income, simplify tenant transactions, and save valuable time on bookkeeping tasks. Let’s dive into the eight simple ways you can use QuickBooks Online to manage your rental income like a pro!

Use a Sales Receipt to Enter Rental Income in Quickbooks Online

In Quickbooks Online, sales receipts are used when money is received for a sale. This is especially useful if you receive immediate payment from tenants. The best part about using receipts is that you don’t have to worry about invoices. This method is especially useful if you have tenants on short-term leases or month-to-month arrangements, where immediate payment is common.

Sales receipt allow you to capture important details, such as the tenant’s name, rental property, and any specific rental periods. QuickBooks Online organized each receipt under rental income, giving you a clear view of your property’s financial health.

This approach simplifies end-of-month reconciliations and makes tax time smoother by organizing rental payments in a way that’s easily accessible for reporting.

The downside of using sales receipts to record rental income is that it requires manual work to record each receipt. This can be time-consuming if you have a lot of properties.

How to enter rental income using a sales receipt in Quickbooks:

- Create an income account for Rental Income (if you have not already done so)

- Transactions > Chart of Accounts > New

- Create a Service for Rental Income in Quickbooks

- Sales > Products and Services > New

- Enter the name of the service and choose the rental income account you create in step 1 as your “Income Account”

- Create your sales receipt

- Click +New > Sales Receipt

- Enter customer, date, and the Deposit to account (the account the rent was received in)Enter the Product/Service you created in Step 2 and add a description

- Complete the remaining fields in the row and click “Save” or “Save and Send”

Use Deposits in the Bank Feed

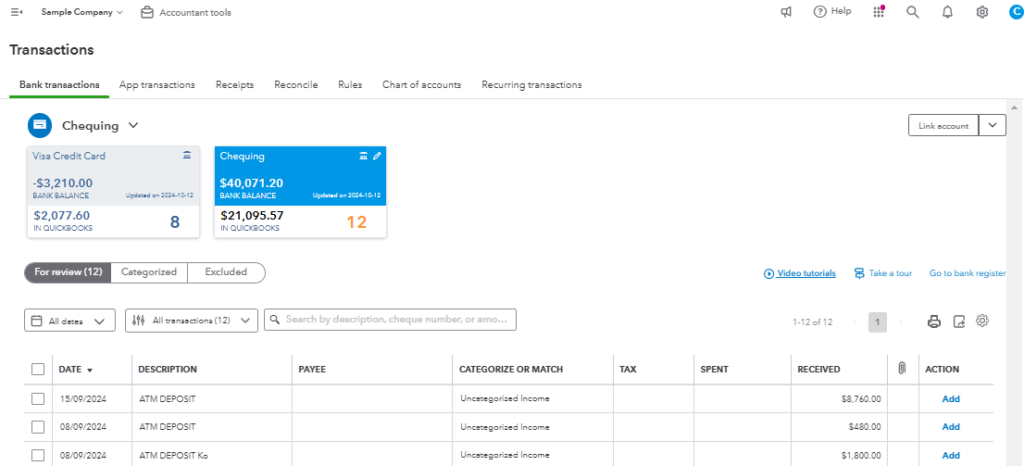

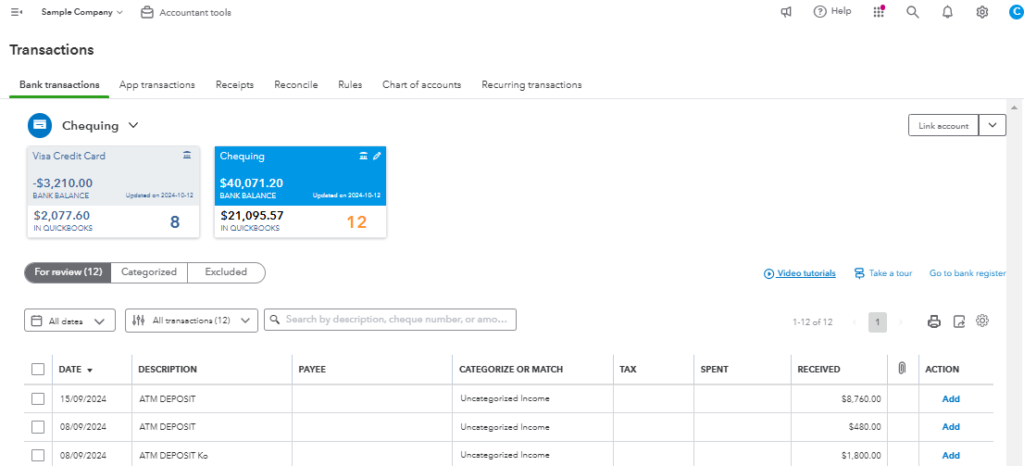

Bank feed in QuickBooks Online is another easy way to record rental income, especially if you receive payments directly into your bank account. The bank feed feature allows QuickBooks users to connect their bank account to the software. The software then automatically imports transactions from the bank including: deposits, and expenses. For property managers or landlords handling multiple tenants and rental properties, this feature makes it easy to record rental income in no time, while reducing data entry errors.

In the Quickbooks software, you can view all recent deposits in the bank in real-time, and categorize the transactions as rental income. Quickbooks can automatically recognize tenant deposits using rules or you can quickly add them manually. These categorized entries feed directly into QuickBooks’ financial reports, making it easy to track monthly income, manage overdue payments, and pull financial summaries come tax time.

The downside of using deposits in the bank feed to record rental income is that you may have to manually track those who miss payments. These individuals will not have a record in the accounting software if you are only using deposits to record rental income.

How to enter rental income using deposits in bank feeds in Quickbooks:

- Create an income account for Rental Income (if you have not already done so)

- Transactions > Chart of Accounts > New

- Connect Your Bank Feed in Quickbooks

- Transactions > Bank Transactions > Link Account

- Find your bank account that receives rental income deposits and connect it to get the feed (list of bank transactions)

- Find the deposit in the bank feed

- Transactions > Bank Transactions > Click on the connected bank feeds to see the list of transactions

- Click and categorized deposit

- Click on the deposit in the bank feed > Select the Categorize option

- Enter the customer’s name, income category, and any applicable tax, then click “Add”

Create Recurring Invoices for Rent in Quickbooks Online

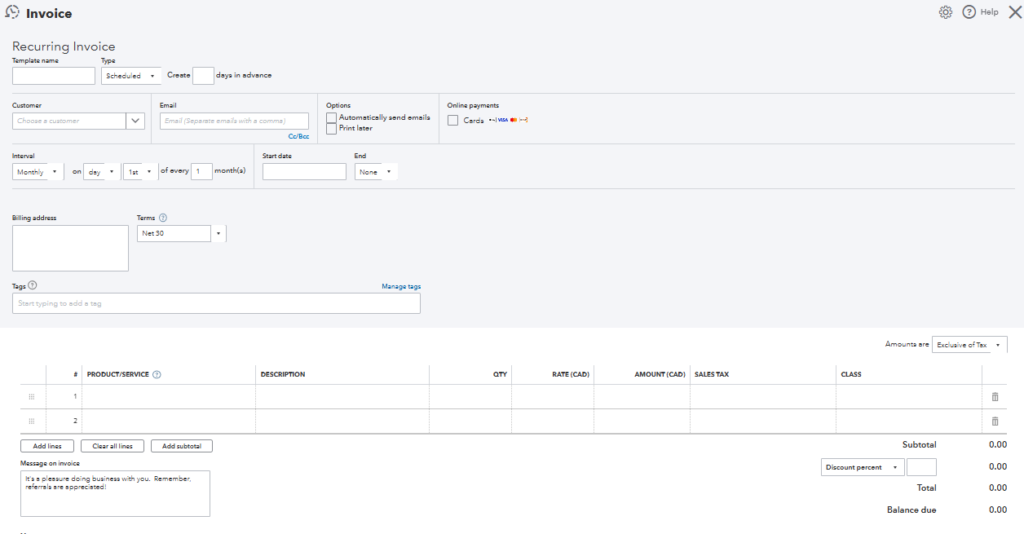

For landlords and property managers with tenants who pay rent on a regular schedule, QuickBooks Online’s recurring invoices feature can be a game-changer. Instead of manually creating an invoice each month, the recurring invoice function allows you to automate the process—saving time and ensuring that every rent payment is accurately tracked. Once set up, QuickBooks will automatically generate and send invoices to your tenants based on the schedule you define, whether it’s monthly, quarterly, or any custom frequency.

Using recurring invoices for rental income in QuickBooks Online not only reduces the chance of missed payments but also helps maintain a steady cash flow by prompting tenants with a professional, timely reminder. Each recurring invoice is customizable, allowing you to include specific details like the tenant’s name, the property address, and any applicable fees or charges.

The drawback of using recurring invoices is that you have to create one for each customer. This can be quite time consuming if you have a lot of properties to track.

How to create recurring invoices for rental income in Quickbooks Online:

- Head over to the reccuring transaction module

- Click the Gear Icon (top right) > Under Lists, click Recurring Transactions

- Choose your template

- Click New > Choose Invoice from the dropdown list > Click OK

- Complete the template (you have to create a template for each rental property)

- Enter template name > leave type of scheduled

- Enter customer name > choose whether you want QBO to send the invoice automatically or if you wish to do it manually later

- Enter the interval of the invoice, the start date, and end date if applicable

- Complete the product/service, description, amount, and sales tax if applicable

- When done, click Save Template

- Repeat these steps 2 and 3 for other rental properties

Create and Import Invoices in Bulk

Creating and importing invoices in bulk allows you to streamline the rental income recording process by setting up tenant invoices all at once rather than manually creating them one by one. This is probably the best and fastest way to record income if you have a lot of properties.

Bulk importing invoices using excel to generate all the invoices in just a few clicks, which is then imported into Quickbooks Online. You can also customize each invoice with tenant details, due dates, and specific rental charges, providing transparency and accuracy for both you and your tenants. This feature is especially valuable if you have a consistent rental cycle—such as monthly rent—where the amounts and due dates remain largely unchanged.

Once invoices are imported, you can send them to tenants or set up recurring reminders, so you never miss a rent cycle. The software will track each invoice, flag overdue payments, and give you insights into your income flow with clear reports. Importing invoices in bulk in QuickBooks Online is an efficient, organized approach that lets you focus on managing your properties rather than being bogged down by repetitive data entry.

The only downside is that you will be entering information manually so you may be prone to errors.

How to create recurring invoices for rental income in Quickbooks Online:

- Prepare your invoice data

- Create a spreadsheet with the following columns: Customer Name, Invoice Date, Due Date, Product/Service, Quantity, Rate, Amount, and Invoice Number. Ensure each row represents a single line item

- Save the excel in CSV format

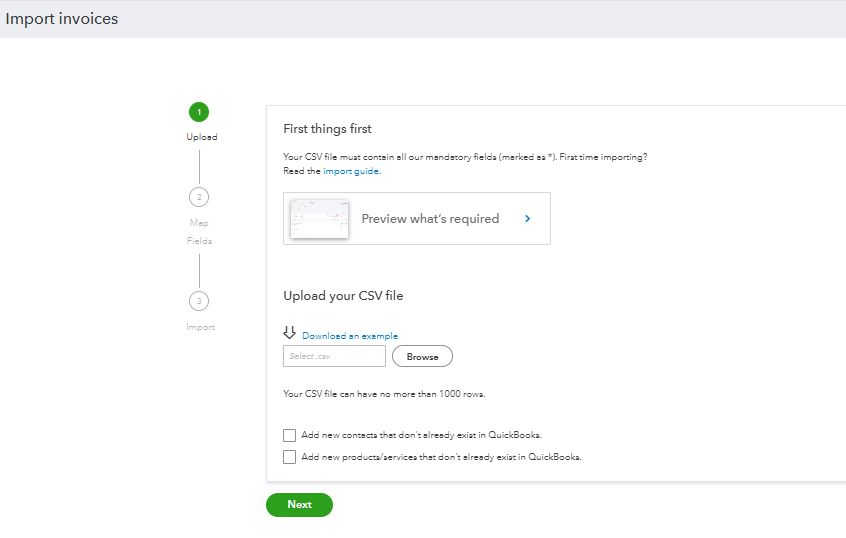

- Use the Import Tool in Quickbooks Online

- Click the Gear Icon > Under Tools, click Import data > Choose Invoices

- Upload the CSV file

- Use the browse button to find and upload the CSV file

- Map your data

- QuickBooks will display a screen to map your CSV columns to QuickBooks fields. Ensure each field (like Customer Name and Invoice Date) aligns with the appropriate QuickBooks field.

- Click Next once mapping is confirmed

- Review, confirm and finalize import

- Follow the Next prompts and if you are happy with your upload, click Import

- Send Invoices (Optional)

- Head over to the invoices you created and send them to customers

Import Sales from Property Management Software into Quickbooks

For landlords and property managers overseeing multiple units, tenants, and income streams, property management software can be a game changer. It can automate rental invoicing, track tenant payments, and handle maintenance expenses—all while syncing seamlessly with QuickBooks. This integration combines the specialized features of property management tools with the robust accounting capabilities of QuickBooks Online, creating a comprehensive solution for property finance management.

While some software integrates seamlessly with QUickbooks, others don’t. For those that don’t having a way to extract information and record it into Quickbooks is crucial.

With the power of property management software combined with QuickBooks Online, you’ll save time, reduce administrative hassle, and keep a closer eye on your rental income.

The only downside of this is the use of 2 software to track rental income. As well as the manual work of importing sales from your property management software into Quickbooks Online.

How to record sales in Quickbooks from a Property Management Software:

- Download sales report from property management software

- Enter sales from property management software into Quickbooks

- Use either a sales receipt or invoice module to record the sales from property management software. You can choose to enter them individually, or do a combined monthly amount.

- Alternatively, you can use the report form the property management software and import all the sales in bulk to Quickbooks online

Use a Journal Entry

Lastly is the use of journal entries. Recording rental income in QuickBooks Online through journal entries is the most difficult method to enter rental income. It is generally not recommended unless you are a training bookkeeper or accountant.

While journal entries are typically used for adjusting entries, they can also be used to enter rental income information. Journal entries allow for a high level of customization, giving you precise control over how rental income flows into your financial reports.

Journal entries allow you to manually enter the sale and deposit account of your rental income. It always requires 2 values that agree with each other. For example, you could credit the rental income account and debit a bank account to show a sale was made and funds were deposited. Think of journal entries as much more simplified version of invoices or sales receipts.

Though journal entries require a bit more setup and understanding of accounting principles, they offer the flexibility and detail that many property managers and landlords need to maintain precise records and optimize their reporting.

The downside of using journal entries is that it is a difficult concept to understand. And if not used properly, it can makes your books a mess.

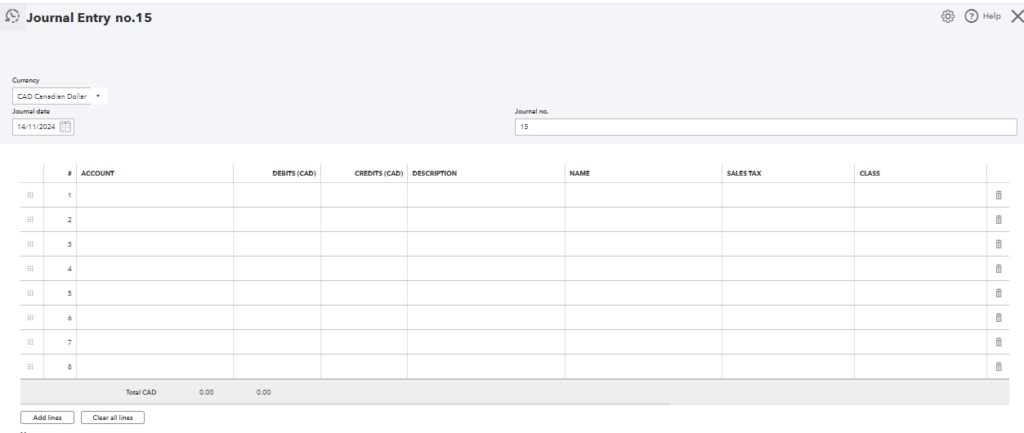

How to record rental income in QUickbooks Online using journal entries:

- Click + New on the left side of the menu, then select Journal Entry under the Other section

- Enter the details of your entry

- Set the date of your entry

- Choose the rental income account as the creditEnter the credit amount

- Chose the bank account the money is deposited as a debit

- Enter the debit amount

- Add any additional details in the Description and Memo sections

- Select Save and Close to record the journal entry.

Your Call to Action

If all of this seems overwhelming, feel free to book a 1 hour consult to see how we can help you manage invoicing and other bookkeeping tasks for your rental property!

Conclusion to Ways to Enter Rental Income in Quickbooks Online

Recording rental income in QuickBooks Online can be straightforward when you know which method best suits your business needs. From using sales receipts for immediate payments to setting up recurring transactions for monthly rent, each method offers unique advantages that make managing rental income simple and efficient. Whether you choose to work with bank feeds, invoices, or even journal entries for more complex transactions, QuickBooks Online provides the flexibility and tools needed to keep your books accurate and up-to-date.

Mastering these methods ensures that you’ll always have a clear picture of your rental income and expenses, making it easier to track cash flow, prepare for tax season, and generate reports to assess your properties’ performance. With these six pro techniques, you can confidently manage rental income in QuickBooks Online, save valuable time, and stay on top of your financial records.