Email Transfer (e-Transfer) are a popular way to receive money from clients for many Canadian businesses. They offer convenience, speed and a level of security for many businesses across Canada. Despite this, however, they may not be the best option to collect money from clients.

Features such as transaction fees, transaction limits, and accessibility pose a challenge for many businesses that use e-transfers as their main payment gateway. As a result of this, many businesses have sought out alternatives to e-transfers for their business payment option in Canada.

In this blog, we go through 8 alternative payments to e-transfers that Canadian businesses can use. These payment alternatives offer innovative solutions and a range of options to cater to various businesses and their needs. No matter your business needs, whether you’re seeking an alternative for large transactions, international payments, or just looking to broaden your payment options, this guide will offer valuable insights and recommendations to help you navigate the diverse landscape of payment solutions available to your business. From established services to emerging digital platforms, these following alternatives present great opportunities for Canadian businesses to optimize their payment processes and stay ahead in today’s ever-changing business environment.

What is e-Transfer?

E-Transfer, previously known as Interact Email Money Transfer, was introduced by Interac in 2003. It was introduced as a means to transfer funds from one bank to another electronically, bypassing the need for physical cash or checks. This process of transferring money could be done through various online platforms making it a quick, convenient, and a secure way to send and receive money. E-Transfer services are provided by the major banks in Canada, including but not limited to TD Canada Trust, Scotiabank, Royal Bank, and many others.

One of the key features that made E-Transfer a success was its speed. Transactions could be completed almost instantly or within a few minutes, depending on the service being used. Secure features such as encrypted and authentication protocols help protect sensitive financial information during the transfer process.

It has become very popular amongst families, friends, and businesses due to its ease of use, eliminating the need to write checks, visiting bank branches, or handling cash. Many use E-Transfers to pay bills, send gifts, pay invoices, and even salaries.

Over the past two decades, E-Transfers have been an integral part to financial transactions in Canada and also worldwide.

How e-Transfer works

E-transfers are very easy to use and can be utilized in two ways, by sending money or by accepting money that is sent to you. First, let’s talk about how to use e-transfer to send money.

How to Send Money Using E-transfer

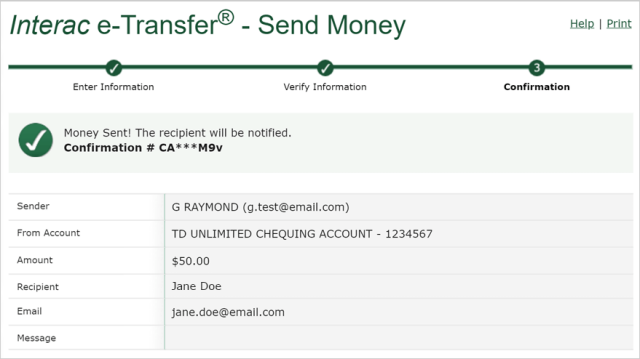

In order to do this, you need to have two main things: 1) an account with the participating bank or credit union and 2) an active email address or mobile phone number. To send money using e-transfer, you can use the following steps.

- First, log into your online or mobile banking app and select the account

- Choose or add your recipient email or phone number.

- Enter the amount to send and a security question. Note that you do not need to do this if your recipient has already registered for e-transfer or to deposits.

That’s all. Make sure that you send the recipient the answer to the security question before or after you send the e-Transfer. It’s important to make the security answer obvious in case the e-transfer is sent to the wrong email or mobile number.

How to receive money using e-Transfer

Receiving money through e-Transfer is just as easy as sending it. In order to receive money through e-Transfer, you can use the following steps

- Check your mailbox, text message or app for a notification of an e-Transfer

- Follow the instructions in the email or message to log into your bank accounts and enter the answer to the security question for the e-Transfer. For those using Autodeposit the fund will be automatically deposited to your account once it is sent to the Autodeposit email.

If done correctly, the funds will be automatically deposited into your chosen bank accounts.

The Problems with E-transfer for Businesses in Canada

Using e-transfers for business transactions, while convenient and efficient can present several challenges that businesses should be aware of. There are five main challenges that e-transfers can pose that business owners should take heed when using it.

1. Security Risks

The main caveat of e-Transfers is the ability to use emails and phone numbers to easily receive and send money. Although these two elements can be safely used for many purposes, they can be a very vulnerable targeting point for phishing attacks, hacking, and even fraud.

When it comes to sending money through e-Transfers, there is the potential of sending money to the wrong email address or phone number through a phishing, hacking, or fraud attack. In the same way, businesses may be subject to receiving fraudulent e-Transfer funds where links to the email could be disguised as viruses, which may compromise your business security.

Businesses must ensure that their e-transfers are secure. That both their systems and employees are aware of these risks and can identify potential security threats in order to prevent them.

2. Transaction Limits

For businesses with large transactions, you may be disappointed to know that e-Transfer services have daily or per transaction limits. This can be very restrictive for businesses that need to transfer large sum of money frequently. In some cases, e-Transfers allows a limit of $3,000 to be transferred per day which may not be suitable for medium to large size businesses with high volume bills or invoices. These limits can impede the flow of business transactions and activities and hinder cash flow significantly.

3. Dependency on Internet Access

Another problem for e-Transfers its dependency on internet access. Without internet access, e-transfers are useless to both sender and receiver. While most other payment gateways require internet access, it is important e-transfers should not be your primary means of receiving or sending money.

E-transfers require reliable internet connectivity. Businesses in areas with unstable internet access may face difficulties in conducting transactions smoothly, potentially disrupting operations and leading to delays in payments and receipts.

4. Limits in Recordkeeping

A key component of payment gateway is the ability to match invoices or bills to payments received or sent. An inability to do so makes it hard to accurately track the status of these invoices and bills.

One of the main features that e-transfer lacks is the ability to match funds coming in or going out accurately. Granted, users of the application can use the message field to enter details of the funds being received or sent, however, users of e-transfers are limited by character limits in these message fields. As a result, funds being sent may be misallocated to invoices. This may cause confusions when clarifying whether or not an invoice has been paid.

5. Integration with Accounting Software

Unfortunately, e-transfers have no ability to integrate with accounting softwares. Although you may be able to see e-transfers being processed within the bank, as mentioned previously, it is nearly impossible to tie the transactions of the e-transfer to invoices or bills. This leads to additional manual entries and increased chances of error within your established accounting system.

For most businesses, these five limitations are enough to deter them from using e-transfers altogether. If, however, you were still on the fence or are considering using e-transfers for your business, give it more thought. As a serious business owner, you must choose a reliable, safe, and efficient payment gateway in order to streamline your business processes and manage cash flow effectively. These 8 alternatives to e-Transfers for businesses in Canada may help you do just that.

Quickbooks Payments – Best e-Transfer Alternative for Quickbooks Online Users

If you’re in the business world and have been looking for an accountant software, you may have come across QuickBooks. QuickBooks is one of the best accounting software for businesses of all kinds, but did you know they also offer ways to get paid?

QuickBooks Payments gives your customers flexible payment options so that it’s easier for you to get paid, regardless of where you work. Due to the fact that QuickBooks is an accounting software first, you can rest assured that record keeping is well taken care of as you receive payments from clients. With QuickBooks, your customers can pay their invoices directly, all online. Once a customer makes a payment, QuickBooks records the payment automatically and matches them to invoices. So, you can keep up to date with record keeping in no time.

The system also has multiple payment options that allow customers to pay conveniently. These payment options include bank transfers, credit cards, and Apple Pay. Customers have the option to pay online, on-site, or over the phone. Once a payment is made, deposits are typically made into your account within the next business day.

QuickBooks also has automations that allow businesses to send reminders to let customers know when a payment is due. It also accompanies this with real-time alerts when they pay. Other automations include setting up pre-scheduled recurring invoices for consultant businesses or other service businesses. With recurring invoices, invoices are automatically sent to customers at a pre-specified time on a recurring basis. As usual, your customers can then choose to pay through credit card or Apple Pay, or they can set up pre-authorized payments for more hassle-free processes.

Unlike e-transfers, bank payments have no limit per transaction, meaning your customers can pay high-value invoices in just one payment directly from their bank account.

Features and Pros:

Here are the features and pros of using Quickbooks Payments:

- Accepts credit cards, bank transfers, Apple Pay

- Low per transaction fee at 1%

- Setup pre-scheduled recurring invoices

- Automatic sync payments to invoices

- Automatic recordkeeping after payments

- Customizable emails sent with invoices

- Automatic payment reminders

- Pay by phone, mobile, or on-site

- Send receipts to clients after payment

- Pre-authorize payments

- Additional benefit of accounting software with Quickboooks Online

Cons:

Just like any other payment gateway, QuickBooks also has its downfalls. Here are some of the cons of using QuickBooks payments.

- Email notifications for payments can be a security risk

- Need to purchase a Quickbooks Online subscription to use Quickbooks Payments

- Limited by internet access and connectivity

- Pre-authorized payments need to be processed manually

- Only accepts payments for invoices but cannot be used to pay bills

Plooto – Best e-Transfer Alternative for Quickbooks or Xero Users

If you are a business using Quickbooks or Xero to send invoices and you are looking for the best alternative to e-transfers, Plooto should be your number one pick. Plooto is a Canadian an all-in-one accounts payable and receivable software that gives your business total control over cash management.

On the account receivable side, Plooto is able to connect directly with accounting software such as QuickBooks and import invoices into the system. From there Plooto is able to send invoices directly to customers with payment instructions. Customers are able to pay the invoices through Plooto using credit card, bank transfers, ACH, EFT and a multitude of other payment options. Once payments are made, Plooto collects the funds into their system, marks the invoices as paid in QuickBooks, then later distributes the income to your bank account directly.

When it comes to creating invoices, you have two options with Plooto. You can create the invoices within Plooto with just a few clicks, or import invoices from another account and software, such as QuickBooks, automatically. Plooto automates the accounts receivable collection process by sending invoices and payment reminders to customers at different intervals, and this can be customized to fit your needs. The platform uses industry standard encryption to safeguard financial data, and is compliant with strict security protocols to ensure that the platform can be trusted. With Plooto, you can create invoices within Plooto with just a few clicks, or import invoices from another account and software, and this can be customized to fit your needs.

For those businesses looking to pay bills, Plooto can also be an impressive option. Similar to customer invoices, bills can also be seamlessly imported into Plooto through another accounting system or manually entered into the accounting system. Bills can be paid through Plooto using a diverse payment option, including secure bank transfers, electronic payments, and for those issuing checks, Plooto can issue those checks on your behalf. Once Plooto syncs with an accounting software, it can pay bills through its platform and automatically mark the bills in the accounting software as paid. Users also have the option to set up recurring payments for regular bills and invoices in order to reduce manual efforts and prevent late fees associated with manual data entry.

Overall, Plooto serves as a robust platform for those looking to upgrade from e-transfers and take control of their cash management solutions. With this you are able to spend less time managing payment workflows and more time growing your business.

Features and Pros:

Here are the features and pros of using Plooto:

- Accounts payable and receivable solutions

- Online check payments

- Various payment options accepted including ACH, EFT, credit card, bank transfers

- Many integrations with accounting softwares

- Canada Revenue payments

- Automated invoice management

- International payments

- Automatic payment reminders

- Invoice payment verifications

Cons:

- Need to pay for subscription to use Plooto

- Limited by internet access and connectivity

- Email notifications to collect payments can be a security risk

Stripe – Best for e-Transfer Alternative for Online Businesses and Subscriptions

Stripe is a one-way financial payment solution for individuals looking to accept payments online and in person. The system is built with customization in mind and the possibilities are endless when it comes to accepting payments from customers or clients for your business.

Stripe works in a few ways. For those who have a website and are looking to set up payment options on the website, Stripe allows for seamless integration to your website in order for customers to check out and pay for products. Alternatively, the software can also be used to create and send invoices to customers in order for them to pay for your services. There is also the option of sending recuring invoices to clients. In either of these options, the software can be customized to make your checkout experience as optimal, creative, or robust as possible.

For those that don’t have an option on their website to connect with Stripe, there may be a slight learning curve implementing the software on your website. That being said, once the software has been implemented, the process from checkout to receiving payments is seamless.

As previously mentioned, the software is one direction, which means it only allows businesses to accept payments. This means it is not best used to manage bills. Sales invoices sent through Stripe can be paid by customers using credit cards or Apple Pay. Users are limited by these options only.

Unlike other payment platforms where the checkout process is initiated with an email to the customer, Stripe’s checkout payment typically starts on the website. This means that for security reasons, only those seeking or actually paying for your service will buy. You don’t have to worry about sending your invoice to the wrong email.

Overall, for those seeking a custom payment solution on their website, e-Transfers may be your best option.

Features and Pros:

- Create and send invoices to clients

- Create recurring invoices

- Accepts credit cards and Apple Pay

- Can be embedded on any website

- Accepts pre-authorized payments

- Fully customizable experience

- Free to use

- Ability to have multiple business accounts

- Integrates with other platforms

Cons:

- Has a bit of a learning curve

- Does not integrate with accounting softwares

- Limited methods of payment

- Limited by internet access and connectivity

Shopify – Best e-Transfer Alternative for E-commerce Businesses

Shopify is one of the biggest platforms for businesses looking to sell physical products. The platform has a plethora of features that allows individuals to start, grow, and manage their businesses all at the comfort of their home. Like the other platforms mentioned above, Shopify makes it easy to get paid and is a great alternative to e-Transfers for e-commerce businesses.

Shopify is an in-house platform for ecommerce businesses and what this means is that sales and payments are made directly on the websites. To use Shopify, you have to build an e-commerce website using their platform. This requires a Shopify subscription. From here, customers can make purchases and payments through your website.

Shopify has its own payment gateway (Shop Pay) which means you do not need to connect any other payment merchants to your website or shop. Shop Pay accepts all major forms of credit cards. Once a customer pays within Shopify, money is directly deposited into your Shopify account which is then later transferred to your bank account. Similar to Stripe, this eliminates the need to send invoices to clients and reduces any risk of fraudulent activities.

Now, even though Shopify has its payment gateway, it does allow for the addition of other third-party payment gateways such as Stripe, PayPal and even a point-of-sale system. These gateways can be connected to your Shopify website in order to give clients additional payment options. The site also utilizes apps to add more features and functionality to your online store in order to create a better experience for customers.

Overall, Shopify makes a great alternative to e-transfer for customers who need an online presence and serve customers in the e-commerce market.

Features and Pros

- Accepts major forms of credit cards

- Has a website builder

- Ability to create and send invoices

- Can integrate other payment platforms

- Contains may apps and features to grow your business

- Has a POS systems for physical locations

- Has a fraud detector for each purchase

- Accepts credit cards and Apple Pay

Cons:

- Requires a subscription to use

- Limited by internet access

- Limited by platform (Shop Pay does not integrate with other platforms)

- Prone to fraudulent activity due to its popularity

Paypal – Best e-Transfer Alternative for Side Hustles

For those who are just starting a business and are looking to get set up quickly without any hassle, PayPal may be the best e-transfer alternative for you. PayPal is a widely accepted payment platform that allows customers to feel more secure about payments and is trusted by millions of businesses worldwide.

The platform accepts payments in person or online. It processes all major credit and debit cards. Customers do not need PayPal to pay. In addition to accepting most major credit cards and debit cards, the platform can also be integrated to other platforms to streamline payments. PayPal works extremely well with other eCommerce platforms such as BigCommerce, Shopify, Wix, WooCommerce, and Squarespace.

Using PayPal is fairly simple. All you need to do is create a free account and from there you have the option of adding PayPal to your website or creating invoices and sending it to your clients for payment. Once a payment is made on your website or on an invoice, PayPal holds the funds until you are ready to transfer it to your bank account.

The platform is a two-way payment merchant which means you can accept money as well as pay bills with your account.

For those working with invoices, PayPal allows you to create invoices sent to your customers and pay either credit card or debit card. Users with their own PayPal account can also pay through PayPal as well. Invoices can be personalized, tracked, and late payments can be accompanied with automatic payment reminders. All of this can be done through your phone. PayPal also offers seller protection guards against eligible and unauthorized transactions, claims of missing items, and more. The recurring invoice feature allows you to create recurring invoices for subscriptions automatically.

For those looking to take their side hustle to the next level, PayPal is a great place to start as an alternative to e-transfers.

Features and Pros

- Accepts major forms of credit cards

- Allow for recurring invoices

- Ability to create and send invoices

- Can integrate with other platforms

- Allows you to send automatic reminders

- Website is not needed to use

- Free to use

- Has seller protection against fraud

Cons:

- Limited by internet access

- Prone to fraudulent activity due to its popularity

- Email invoices can be a fraudulent risk

- Does not integrate directly with accounting softwares

Square (Square Up) – Best e-Transfer Alternative for Brick-and-Mortar and In-Person Sales

If your business is a brick and mortar or you make in-person sales but are still using e-transfer for your main payment method, it’s time to make the change today. Some businesses looking to elevate their business and move away from e-transfers can look to Square as an alternative. Square is a payment gateway that is perfect for businesses looking to sell in-person and even those looking to sell online.

For those looking to get paid online, the platform allows users to create unlimited invoices and estimates from anywhere. This also includes recurring invoices. For these recurring invoices, you can save and charge cards on file and even schedule automatic payment reminders for late payers. Once a customer pays an invoice, it can send digital receipts to them in an instant. The platform offers multiple ways in which to request, accept, and record all types of payments. This can include requesting and collecting payments through email, SMS, or through a shareable link. They even offer an option for customers to pay later with Afterpay and accept contactless or chip and PIN payments with the Square Invoices app or the Square Hardware POS systems.

In-person sales can also be a breeze with Square with their POS systems. From registers, terminals and even readers, there is a solution for anyone looking to get paid.

Square integrates with other commerce platforms but does not integrate with accountant systems. Although the platform has its own interface to allow business owners to view finances and reports, it is not robust enough to use as an accounting system. As such, those using Square will most likely need an additional accounting system to get a full picture of their business activities.

Features and Pros

- Accepts major forms of credit cards

- Allow for recurring invoices

- Ability to create and send invoices

- Can integrate with other sales platforms

- Allows you to send automatic reminders

- Website is not needed to use

- Free to use

- Has seller protection against fraud

- Create payment links, buttons or QR codes

- Allows users to pay later

- Custom POS solutions for in-person sales

- Inventory management

Cons:

- Limited by internet access

- Still need an accounting software

- Email invoices can be a fraudulent risk

- Does not integrate directly with accounting softwares

GoCardless – Best e-Transfer Alternative for Xero Users

GoCardless is made specifically for Xero, which makes it a great alternative for e-transfers for those using Xero.

The main feature of GoCardless is its ability to collect payments using direct bank-to-bank transfers which means no card fees. However, it does not allow for payments through credit cards. The platform is great for invoices, subscriptions, or recurring payments. It is free to use and only charges on a per transaction basis.

GoCardless can be used on its own or can be connected directly to Xero to make invoice management easy. Due to the fact that it acts mainly as a payment collection hub, it has limited features when it comes to creating and issuing invoices. Uses will get the most out of the platform by connecting it to Xero or another accounting platform. Once GoCardless is connected to Xero, invoices can be sent to clients who can then be prompted to make payments using GoCardless. The platform also connects to other content software such as QuickBooks and Sage.

Features and Pros

- Allow for recurring invoices

- Collects and reconciles invoice payments automatically

- Can integrate with other accounting platforms

- Allows you to send automatic reminders

- Website is not needed to use

- Free to use

Cons:

- Limited by internet access

- Still need an accounting software

- Does not accept credit cards

- Unable to be used completely alone

Wave Accounting Payments – Best e-Transfer Alternative for Wave Accounting Users

For those using Wave Accounting and still collecting payments through e-transfers, did you know Wave Accounting has its own payment processing gateway? With Wave Accounting, you can use their platform to send invoices and also collect payments.

Some of its features include a user-friendly dashboard built for business owners. A built-in accounting system to help you track all business activities. And in-house teams of bookkeeping, accounting, and payroll coaches to help you through your business journey.

Wave Accounting boasts an impressive invoice software that allows you to create invoices quickly and send to your customers. For businesses that require recurring billing and invoicing, Wave also allows you to create recurring bills or invoices. However, this can only be done with the pro plan. This feature also allows you to automatically collect payments for repeat customers. Once invoices are paid, all payments and invoices are automatically synced with Wave’s accounting feature.

The payment gateway built within Wave software is compatible with Apple Pay, all major credit cards, and even ACH and EFTs. This software allows users to accept credit card payments over the phone, online, or in person. Once a customer makes a payment using its payment gateway, funds are transferred to your bank account within a few days.

Additional features of the platform include payroll management software as well as certified advisors to help you through your business journey. The in- house advisors can provide you with one-on-one coaching or they can fully manage your bookkeeping.

Wave Accounting Payment is a stand-alone feature within the Wave software and therefore cannot be paired with any other software or accounting systems. Regardless, the many features within its package makes it a great alternative to using e-transfers for your business.

Features and Pros

- Allow for invoicing, payment collection, and reconciliations all in one place

- Collects and reconciles invoice payments automatically

- Sends automatic reminders

- Website is not needed to use

- One on one accounting and payroll support

- Accepts all major forms of payments

- Free to use

Cons:

- Free plan has limitation

- Accounting software has many limitation

- Payment software cannot integrate with other platforms

- Does not allow other payment gateway integrations

Conclusion to Best Alternatives to e-Transfers for Canadian Businesses

The list above is a testament that you no longer need to be using e-transfers to run your business. Although e-transfers offer a convenient way to get paid within Canada, it definitely has its limitations which cannot be overlooked. The alternatives mentioned above offer a range of features which make it easier to run a successful business and get paid conveniently for it. If you’re a business owner in Canada, which payment platform do you use to run your business?