As a Podcaster, managing your creative activity is just as important as managing the financial side of your business. Bookkeeping is an essential part of every Podcasters’ business venture. This is why using the right software is important. QuickBooks is a very powerful tool that simplifies bookkeeping for Podcasters so that they can focus on their clients. Regardless of whether you’re starting out trying to scale your Podcasting business this guide will help you get the essentials of using QuickBooks Online. It will help you organize your finances, track profitability and be prepared for tax season.

This guide will cover everything from setting up your QuickBooks, connecting your podcasting software to QuickBooks to streamline your tasks, and a bookkeeping task schedule for Podcasters.

If you’re serious about your podcasting business and its growth, this article is for you let’s get started.

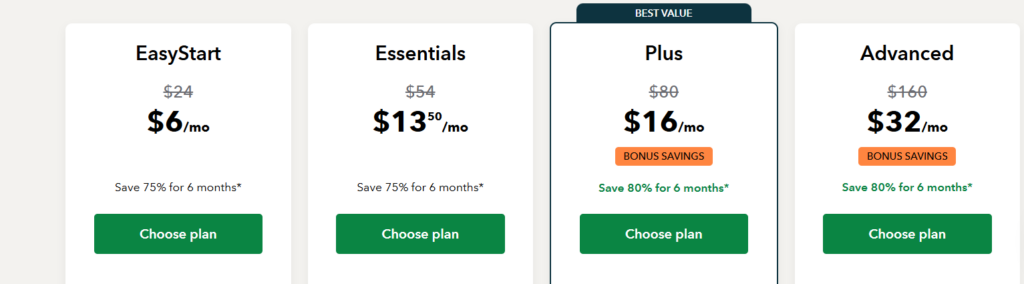

Choose the Best Quickbooks Plan for Podcasters

QuickBooks Online offers plans tailored to fit many podcasting businesses regardless of their journey. The software comes with four main plans: Easy Start, Essentials, Plus and Advanced. The plan you choose will be based on where you are on your podcasting business journey and where you plan to go.

Easy Start Plan

Let’s first discuss the Easy Start Plan. Now this plan is mostly serious for businesses who are just starting to get your feet wet or just starting out have a few expenses and are not making a lot of sales. With this you get the bare minimum of the software without the option of getting an Accountant or Bookkeeper to help you out. You are basically on your own with this plan.

Nevertheless, you still get quite a lot to work with for your business. With the Easy Start plan you can issue invoices and accept payments track yourselves and sales taxes capture organized receipts send estimates run reports and track expenses. But the easy start will not allow you to do however this track any bills. If you are a business that pays for expenses right away, the need to track bills may not matter in this instance.

Essential Plan

The Essential plan is suitable for those who have an established business and are making quite a bit of sales. If you plan on using this plan it probably means you have a steady flow of income coming in for your business, you have a few clients under your belt and you’re actually running your business. This plan is this plan is suitable for those who are working on your business either full-time or part-time. The business is no longer a hobby.

With this plan you get everything in the easy start plan but you can now manage bills and payments, use multi-currency, and also seek the help of others including accountants or bookkeepers.

This plan will be sufficient for most podcasting business owners.

Plus

The Plus plan is suitable for those growing Podcasting businesses who are now working on the business full-time. What does plan you get everything in the easy start and essential plan with the addition of a few things. You can help you can now track individual projects, inventory, create and manage budgets and also track classes and locations. This will be especially helpful in better managing profitability within your business.

Advanced

Lastly there’s the advanced plan. This plan is better suited for individuals who are past their growth stages of the podcasting business and are now running a multi-million firm with many moving parts. The advanced plan offers many means of automations that wouldn’t otherwise be included in the other three plans. These include workflow automation, batch invoicing, a desktop app, recognizing fixed assets and revenue, more spaces for users to control different parts of the software, custom reporting fields and many more.

Generally speaking, the advanced plan is not necessary for the majority of businesses. The plan you choose will be based on your vision and how you want to manage your podcasting project in Quickbooks. If you don’t plan on using the software to manage projects, the Easy Start or Essential plan will suffice. However, if managing project is an essential core of the Podcasting business then you should probably settle for the Plus or Advanced plan.

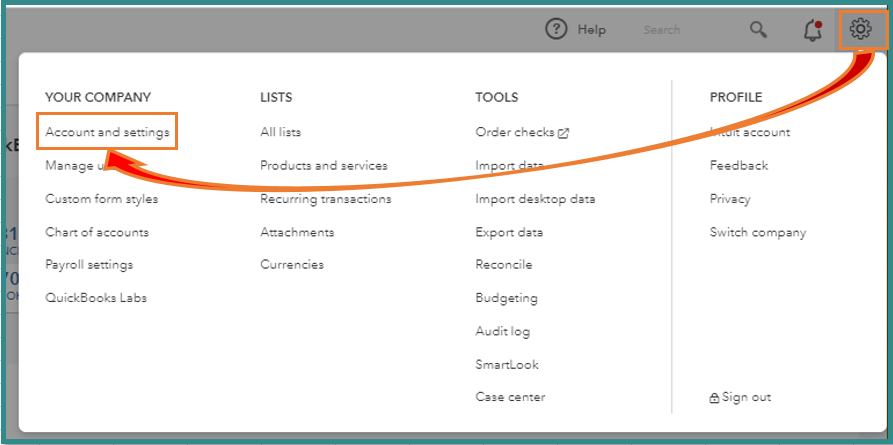

Optimizing Quickbooks Settings for Podcasters

QuickBooks Online offers customizable features that can streamline financial management for podcasting businesses. By optimizing key settings, you can better track expenses, manage client commissions, brand deals, and streamline invoicing. Here’s how to configure QuickBooks for your podcasting business:

1. Enable Classes and Locations Tracking

If your pet sitting business has multiple locations, regions, or you want to track mini projects, you might want to turn on classes and locations. This allows you to categorize transactions by project, or even type (of animal). To enable this feature:

- Go to Settings > Account and Settings > Advanced.

- Under Categories, toggle on Track classes and Track locations.

- Use classes to track classes (e.g., special projects, promos, brand deals, etc) and locations for specific regions to track clients.

2. Optimize Products and Services Settings

Accurately track materials and services offered to clients:

- Go to Settings > Products and Services.

- Enable Track quantity and price/rate to monitor inventory and pricing.

- Add categories for advertising revenue, merchandise sales, events/workshops, and subscriptions.

3. Set Up Reminders

Avoid late payments with automatic reminders:

- Go to Settings > Sales > Reminders.

- Customize messages for due dates, overdue invoices, and upcoming deadlines.

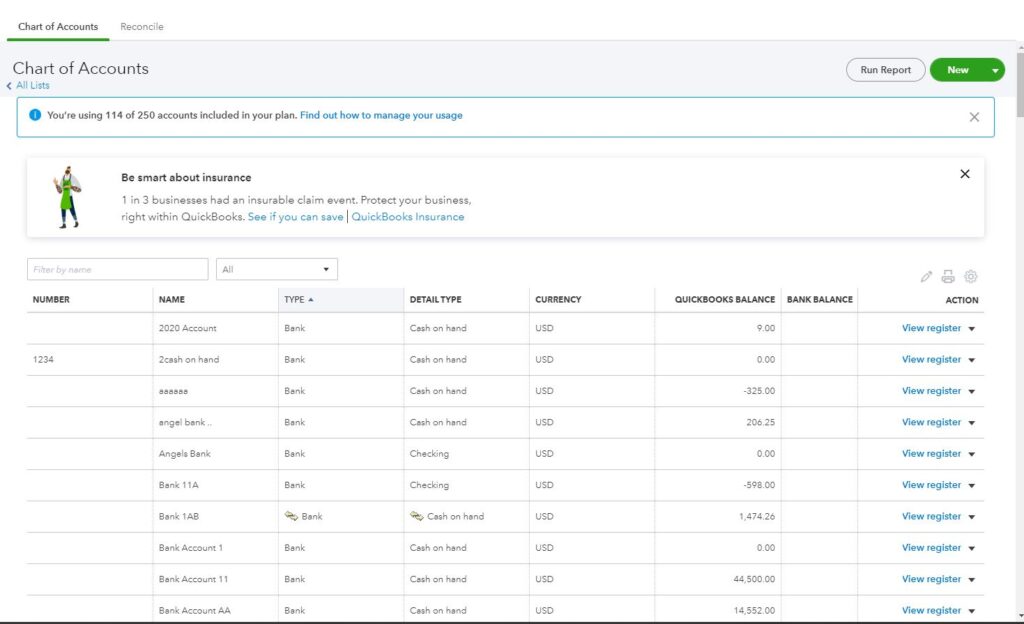

Creating Categories Specific to Podcasters using Quickbooks Online

You can use categories to organize your financial records effectively. These categories are known as chart of accounts. QuickBooks Online offers customizable categories to streamline bookkeeping, ensuring clear financial tracking and insightful reporting. Podcasters can set up categories tailored to their unique needs, focusing on assets, liabilities, income, and expenses to maintain accurate records and improve profitability. You can make the categories as simple or as detailed as you wish. You can also use subcategories to organize your categories as well. Here are the main categories you can setup to help you organize your finances in Quickbooks.

Assets

Assets often include tools, inventory, accounts receivables, chequing accounts, equipment, and office furnishings. Generally, these are things that will help you make money over time.

Liabilities

These are outstanding obligations, including credit card balances, loans for office equipment, or lines of credit used to finance larger projects.

Income

The income categories should reflect the diverse revenue streams of podcasters. Podcasters can create categories for advertising revenue, merchandise sales, events/workshops, and subscriptions. Separating income by type allows podcasters to identify the most profitable services and track sales tax collected on billable items, ensuring compliance with tax regulations.

Expenses

Expenses are the largest category and include a range of costs associated with podcasting. Podcasters can set up expense categories for microphones, video recorders, website costs, travel costs for site visits, and marketing expenses. If you want to track inventory, you can use the cost of goods sold (COGS) expense to ensures that material costs related to specific projects are matched against income.

Equity Accounts

The equity accounts show ownership in the business. Generally, these accounts are setup by a bookkeeper or accountant.

By tailoring categories in QuickBooks Online to reflect the workflows and transactions unique to podcasting businesses, you can create a clear financial picture for your podcasting business.

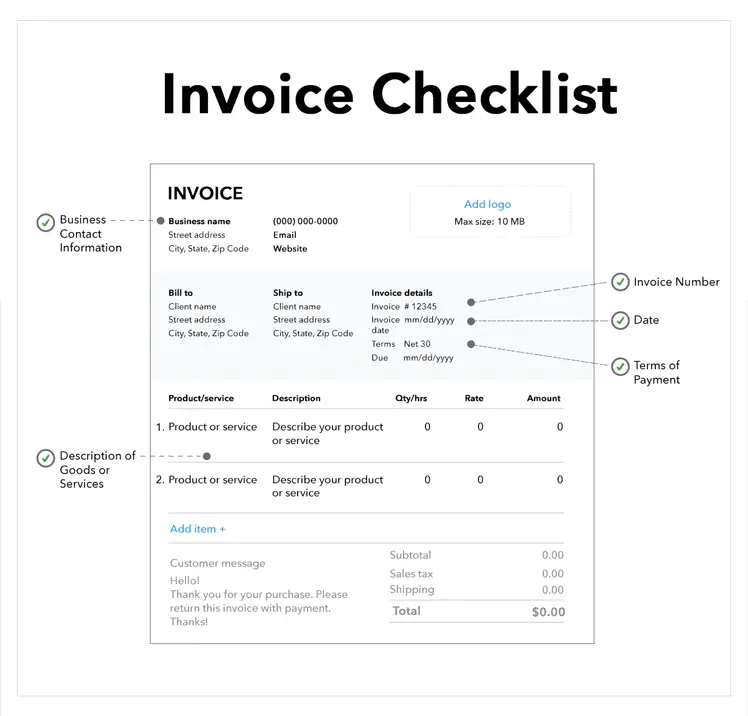

How to Create Invoices in Quickbooks for Podcasting Businesses

Creating invoices in QuickBooks Online for a podcasting business is a straightforward process that allows you to bill clients for your services, materials, and projects. There are 3 phases to creating invoices properly for your podcasting business. These include: customizing your invoice template, creating products and services to use for your invoices, and finally, actually creating your invoices.

Creating Invoice Templates in QuickBooks

Before you create any invoice in Quickbooks, you have to create your invoice template. You can use the default template but Quickbooks allows you to spruce it up a bit.

Quickbooks allows you to change your invoice style, colour and contents. To change your invoice template, do the following:

- Start by logging into your QuickBooks Online account and navigating to the gear icon in the upper-right corner.

- Select “Custom Form Styles” under the “Your Company” section.

- From there, click on the “New Style” button and choose “Invoice” to begin customizing your template.

Use the “Design” tab to select a layout that reflects your brand. You can upload your business logo, adjust font styles, and select colors that align with your company’s aesthetic. Pay attention to the header, ensuring your business name, contact details, and logo are prominently displayed.

In the “Content” tab, you can structure your invoice to highlight specific sections. Customize the header, body, and footer to include details important to your podcasting business. Breaking down the charges to make it easier for clients to understand the value of your work.

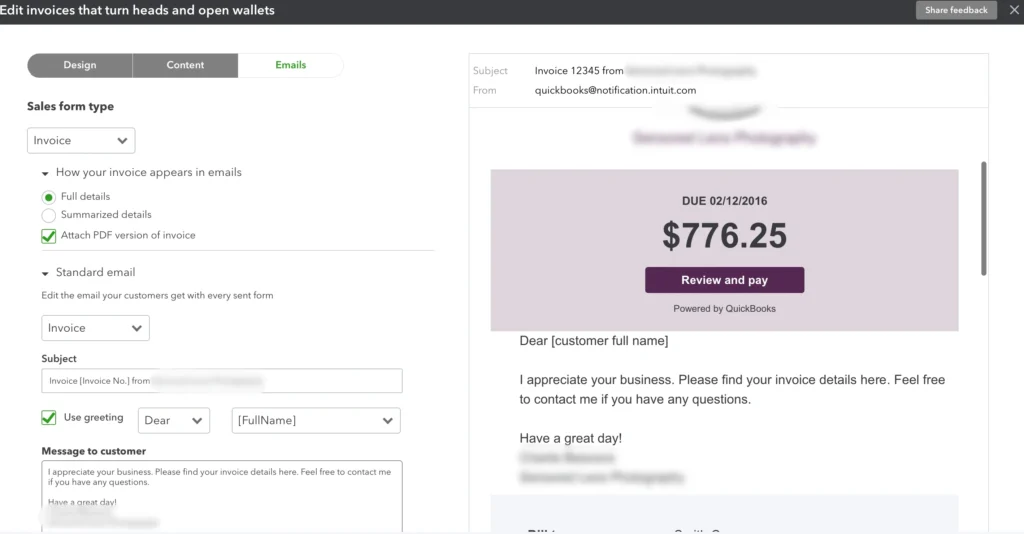

Next, in the “Emails” tab, craft a professional email template that will be sent along with your invoices. You can personalize it to greet clients by name and include a short message outlining the attached invoice and payment instructions.

Once you finalize the design, preview your template to ensure it looks polished and professional. Save the template, and it will be available whenever you create new invoices.

Create Products/Services to Use for Your Invoices

Once you are happy with your template, you can start creating your products/services.

To get started:

- Log in to QuickBooks Online and navigate to the Sales tab

- Select Products and Services. From here, you can add each product or service your Podcasting business offers, ensuring proper categorization for financial tracking. For example, you might create services like “subscription sales,” “brand deal revenue” or “live events” along with any physical products you sell, such as décor pieces or furniture. Each item should include a name, description, and rate, making it easier to itemize charges on client invoices.

When setting up services, be sure to assign them to the correct income account, to accurately track them. Products can be linked to the appropriate expense account if you are tracking inventory and stocks as well.

Create Your Invoice

It is pretty straightforward to create an invoices in QuickBooks Online for a podcasting business.

- Simply log in, select + New and click Invoice under the Customers section.

- Enter the client’s details, including name, email, and billing address. In the product or service section, select the products or services you created in the previous section.

- Adjust quantities and rates as needed, and include sales tax if applicable.

- Once you are happy with all the sections, you can send directly to client via email or save it for later.

Once the invoice is sent, customers can pay using a link in their invoice email.

How to Create Estimates in Quickbooks for Podcasting Business

Creating estimates for your podcast business in Quickbooks is similar to creating invoices. Start by:

- Clicking the + New button and selecting Estimate under the Customers section.

- Enter the client’s details, project description, and estimated costs for materials, labor, and design fees.

- Once complete, review the estimate and click Save and Send to email it directly to the client.

Clients have to manually reply to you directly to accept or reject the estimate. Unfortunately, there is no other option in the estimate email for them to do this. Once accepted or rejected, you can adjust the status in Quickbooks to match this.

Estimates can be tracked and later converted into invoices to send to clients. You can also partially invoice estimates once they are created until the job is completed.

How to Collect Payment in Quickbooks for Podcasting Businesses

For podcasters looking to get paid using Quickbooks, you can do so easily. Payment collection options can be turned on in the “Company Settings” of the software under “Payments”. Once an invoices is created, the payment option will be available on invoices and turned on. When the invoice is sent, clients can pay directly through the invoice using credit cards, debit cards, or bank transfers, ensuring quick and secure transactions.

Payment reminders can also be turned on to reminder and follow-ups on late payments. This is done when you are creating your invoices. Once a payment has been made, it is automatically matched to an invoice in real-time, saving you time and reducing errors. By simplifying payments, you can focus more on designing spaces and less on chasing unpaid invoices.

Setup Sales Tax for Podcasters

If your podcasting business collects sales tax, Quickbooks can accurately track this for you too. Start by enabling sales tax in QuickBooks by navigating to the “Taxes” tab and selecting “Set up sales tax.” QuickBooks will guide you through adding your business location and determining the appropriate tax agencies based on your province or territory.

After setup, create tax rates for each province or jurisdiction where you operate. Assign these rates to invoices and sales receipts to automatically calculate taxes. Regularly review reports under the “Taxes” tab to track collected taxes and ensure timely filing with tax authorities. Proper setup saves time and minimizes errors, keeping your Podcasting business organized and compliant.

Track and Manage Expenses and Bills in Quickbooks Online

Managing expenses and bills effectively is crucial for the success of a podcasting business. QuickBooks Online simplifies this process by allowing you to track every transaction in real time, ensuring you stay on top of costs for materials, subcontractor payments, and project-specific purchases.

There are a few ways to track bills and expenses. You can scan or email your receipts or bills directly into QuickBooks to process. The bank feeds can also be used to categorize expenses and match them to invoices or projects. If you have recurring bills/expenses, you can also schedule them for processing and payment.

By keeping all your financial data organized in one place, QuickBooks Online makes it easier to monitor cash flow, create budgets, and generate reports that help guide future business decisions.

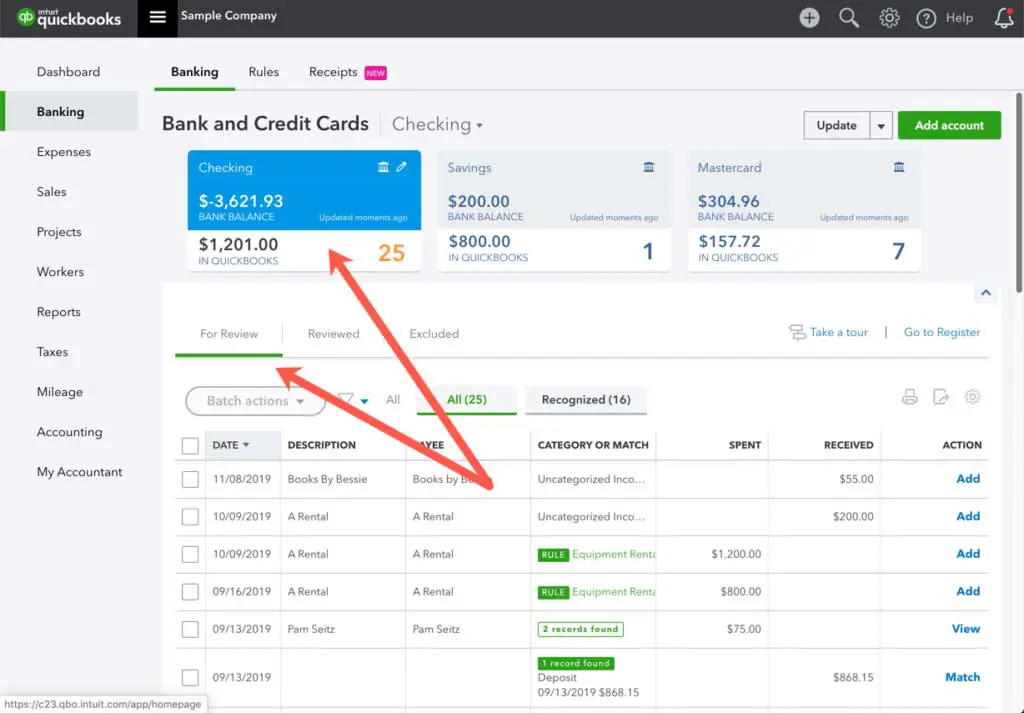

Connect Your Bank Account to Quickbooks

Syncing your podcasting business bank accounts with QuickBooks Online can help you in a lot of ways. By linking your account, transactions automatically import into QuickBooks. That means you can track expenses, manage cash flow, and reconcile bank statements effortlessly.

Whether you’re purchasing decor samples, paying contractors, or invoicing clients, having real-time financial data ensures you stay organized and make informed decisions.

Setting up the connection is quick:

- Navigate to the “Banking” tab, select “Link Account,” and follow the prompts to connect your bank securely.

- Once linked, you can set rules for Quickbooks to automatically categorizes transactions.

Connecting Softwares to Quickbooks Online

Integrating QuickBooks Online with your podcasting revenue generating softwares can take your bookkeeping to a different level. These platforms simplify various trackings, invoicing, and client communication, while QuickBooks Online manages bookkeeping, expenses, and taxes.

Not all of the softwares can connect to Quickbooks. For those that cannot, you may have to manually upload reports into Quickbooks.

For those that can connect to Quickbooks, designers can sync invoices, payments, and expenses seamlessly, reducing manual data entry and minimizing errors. This integration provides a centralized system for tracking profitability, managing budgets, and generating financial reports, ensuring Podcasters stay organized and focused on creativity rather than administrative tasks.

Setting up the connection typically involves enabling integrations within the platforms and authorizing QuickBooks Online access, making it easy to maintain accurate financial records in real time.

Hire a Quickbooks Online Accountant for Podcasters

Hiring a QuickBooks Online accountant for your podcasting business can save you time and major costs down the road. With specialized knowledge of QuickBooks Online, our team can ensure accurate bookkeeping for Podcasting businesses, from tracking income and expenses to managing taxes and payroll. We can also provide valuable insights into cash flow, helping you make informed decisions about budgeting and investments. By outsourcing your bookkeeping tasks, you can reduce errors, save time, and ensure compliance with industry standards, all while staying on top of your finances.

Dedicated Bookkeeping for Podcasters

Let’s Connect!

Bookkeeping Task Schedule for Podcasters

We can closely with clients to ensure accurate bookkeeping for Podcasters by following a task schedule. This ensures that everything from daily transactions to yearly tax preparations is accounted for.

Here is what a schedule can look like.

Daily Bookkeeping Tasks

On a daily basis, the primary tasks involve recording all transactions, such as expenses for materials, design services, and any other business costs. This includes logging client payments, reconciling receipts, and categorizing bank transactions.

Monthly Bookkeeping Tasks

At the monthly level we reconcile bank and credit card statements with your records, ensuring that every transaction matches. This is also the time to update your accounts receivable and accounts payable reports, making sure outstanding client payments and vendor invoices are properly tracked. We also send financial reports for the previous months so you can see how your business is doing. Another important monthly task is to prepare and file sales tax returns if applicable, keeping compliance in check.

Quarterly Bookkeeping Tasks

On a quarterly basis, tasks expand to include reviewing your financial statements, such as the profit and loss statement and balance sheet, to get a clearer picture of your business’s health. This is a great opportunity to analyze trends, adjust budgets, and identify areas of improvement. You should also prepare and submit any quarterly tax payments, ensuring that you are staying ahead of deadlines and avoiding penalties. Additionally, quarterly is a good time to revisit your pricing strategies and assess whether adjustments are needed based on financial performance.

Annual Bookkeeping Tasks

Finally, on an annual basis, you will focus on tasks that wrap up the year’s financial activities and set the stage for the upcoming year. This includes preparing for tax filings, reviewing the year’s overall financial performance, and meeting with an accountant to ensure everything is in order for tax reporting. A comprehensive review of business expenses and income should also take place to identify potential deductions or savings for the next year. Annual tasks also involve setting a new budget, making sure your goals align with your long-term growth strategies, and updating any financial tools or software you use to keep your accounting methods efficient.

Conclusion to Bookkeeping for Podcasters with Quickbooks Online

In conclusion, QuickBooks Online offers podcasters a powerful and efficient tool to manage their finances, streamline their accounting processes, and ensure their business runs smoothly. By leveraging its features, such as project tracking, expense categorization, invoicing, and tax management, Podcasters can focus more on their creative work while maintaining financial clarity. With the right setup and regular maintenance, QuickBooks Online can help Podcasters stay organized, save time, and make informed financial decisions, ultimately contributing to the long-term success and growth of their business.