Although there are no specific tax deductions for sole proprietors in Canada, there are many ways in which they can reduce their taxes this upcoming tax season.

This guide offers some of the top strategies to lower your taxes as a sole proprietor in Canada and keep more money in your business.

Note that this guide is only applicable to those that run a sole proprietorship or partnership and file their income tax using a T1 return. It may not apply to corporations.

Here are 7 tax deductions for sole proprietors to pay less taxes.

1) RRSP Contribution Tax Deductions for Sole Proprietors

RRSP are by far the best tax deductions you have to your advantage as a sole proprietor.

What as RRSP contributions?

RRSP stands for Registered Retirement Savings Plan. It is a retirement savings and investing plan for employees and those self-employed in Canada.

An RRSP fund can be opened by an employer (if they have one), or through any local bank. Pre-tax money is placed into an RRSP fund, typically set up with a bank or employer. At retirement or to buy your first house, the funds can be taken out tax free. If however, funds are withdrawn before your retirement age, it will be taxed.

How RRSP Contributions Lowers Yours Taxes?

The Canada Revenue Agency allows anyone, up to age 71, to contribute to their RRSP fund.

Any amount contributed to your RRSP (or your spouses RRSP), deductible on your personal income tax (T1). You can contribute and deduct up to a limit which is calculated for you by the CRA. This RRSP deduction limit can be found on your most recent Notice of Assessment.

Sole proprietor businesses should always save profit. This should be used to contribute to their RRSP if you anticipate a year in which you have to pay taxes. This is ideal in reducing the amount of tax you have to pay to the government.

2) Ask Employer to Deduct More Taxes on Pay

Sometimes, small businesses needs a second job to pay the bills. And one of the biggest reasons they get taxed a lot is because they have multiple streams of income. If you have a small business and a second job, it is crucial that you increase the amount of taxes being taken from your place(s) of work. This is especially true if your self employed business is profitable.

This extra tax deduction from your employee pay can save you a lot surprises during tax season.

How to Ask Your Employer to Deduct More Tax from my Pay

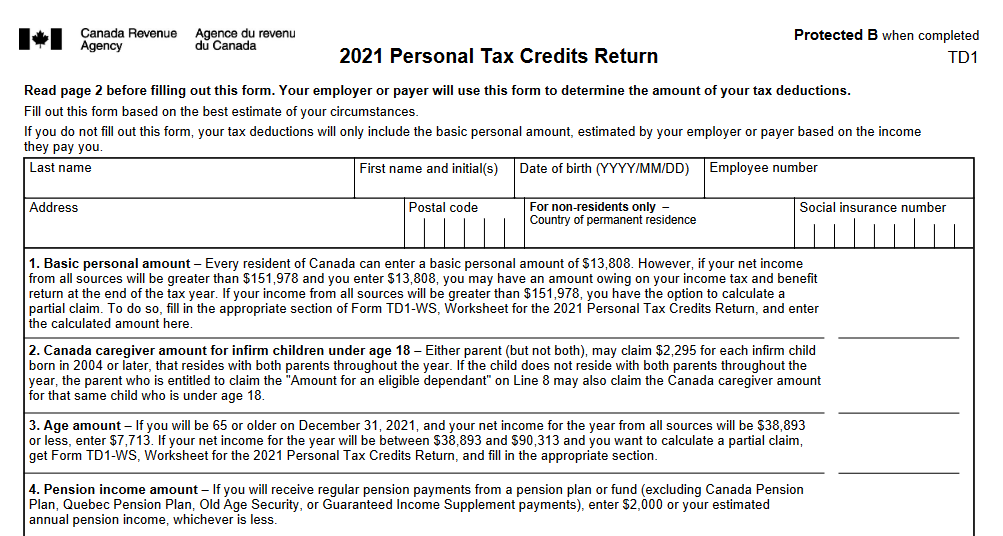

To ask your employer to deduct more tax from your pay, you have to file out a TD1 Federal form (and provincial form). You probably remember this form when you first joined your place of work. It looks something like this:

Typically, we claim the most basic tax deduction amount from every pay but did you know you can deduct more taxes from your pay?

On page 2 of the TD1 Frederal form, you will find a section called “Additional Tax to be Deducted”. This sections is made for those who have multiple sources of income. In this section, you can put the amount you want to deduct on each pay so that you don’t to pay as much tax when you file your income tax and benefit return. Once completed, the form should be returned to your employee for processing.

If you find you have enough taxes collected on your pay and don’t want additional taxes collected, you can re-fill the form and leave the “Additional Tax to be Deducted” section blank so that your employee can take out the basic amount of taxes.

3) Re-invest profits back into company

Another way small businesses can pay less taxes as a sole proprietor is by investing profits back into the company. The whole point of having a small business, is to hopefully grow it into a large one.

Re-investing profits back into the company, means using the profits to make purchases that will help grow your business. These expense, can in returns be used as deductions for the business.

Some ways to re-invest profits back into the company include: buying more inventory to meet sale demand, hiring people to take care of business tasks, spending more on marketing to reach mroe people, etc. The point of this is to use some of the profits to help continue the growth of the business. These expenses can then be claimed on your taxes so that you don’t have to pay it to the CRA.

4) Make Charitable Donations to Registered Charities

Making charitable donations to a registered charity (see list of registered charities here) is another big way in which you can pay less taxes as a small business. Any of the charities on the above website can issue official donation receipts which is a requirement to claim donations.

Generally speaking, an individual can claim up to 75% of their net income in donations. If your donations is of a certified cultural property or ecologically sensitive land, you may be able to claim up to 100% of your net income.

Here is the best part. You receive tax credit on the donations, both on a Federal and Provincial level. And, any eligible amount you give above $200 qualifies you for a higher rate. Here is an example from the CRA website to explain this:

– Danielle lives in the province of Saskatchewan and donated $400 in 2013 to registered charities:

– The federal charitable tax credit rate is 15% on the first $200 and 29% on the remaining $200. Her federal tax credit is therefore (15% × $200) + (29% × 200) = $88.

– The provincial charitable tax credit rates for Saskatchewan for 2013 are 11% on the first $200 and 15% on the remaining $200. Therefore her provincial tax credit is (11% × $200) + (15% × $200) = $52.

– Her combined charitable tax credit is ($88 + $52) = $140.

Based on the example above, Danielle can was able to claim $140 in tax credits based on a $400 donation.

I love this way of reducing your taxes because your money is going a cause that you care about.

Here is a bonus tip regarding making donations. If you make donations to Provincial political parties, you can gain even more tax credits than just donating to a charity. You can read more about this on your provincial website.

5) Split Your Income Tax Deductions for Sole Proprietors

Splitting your income is another great way to reduce the amount of taxes you owe for your small business . Generally, individuals with higher income are generally subject to a much larger marginal tax rate. Therefore, if you can offset some of that income to a family member, you can reduce your income enough to bring you into a lower tax bracket and pay less taxes.

This is a great strategy for small business owners with children of post-secondary school age. You can hire your daughter or son and pay them a salary, say $10,000, to a lower tax bracket. Because of the basic personal income tax exemption, your daughter or son, would pay very little income tax. Meanwhile, you’ve lopped $10,000 off your income for the year, decreasing the amount of income tax you personally owe.

This works best if your family member has very little or no other means of income during the year. Always ensure the amount you pay to your family member is justified. And always have paper work for hiring your family member and a description of the job they did/do.

The rules for income splitting are complex and have been tightened recently, so be sure you know the current CRA guidelines before you plan on this deduction.

6) Look for Home-Based Business Deductions

One of the greatest advantages of being a sole proprietor is that your business is intertwined with your personal life. If you operate your business from home, this means that a lot of things you do at home can be claimed on your income tax (if it is business related of course).

A few things sole proprietors forget they can use as deductions if they work from home include:

- electricity bill

- internet bill

- phone bill

- water bill

- purchases of furniture to work on

- food (to some extent)

- rent

- property tax

- mortgage interest…and more.

Basically as long as a home expense can reasonable be justified for business use, it can be claimed as a deduction for the business.

A good idea for this is to make sure you keep the receipts of all home related expenses. We have a few tools to help you with this.

7) Maximize your CCA Allowance

CCA is Capital Cost Allowance and it is one of many ways in which businesses reduce taxable income in Canada. It’s a tax deduction used to claim for the loss in value of capital assets (assets typically priced at over $500) due to wear and tear or obsolescence.

If you buy a property like furniture or a computer, or other a piece of equipment to use in your business, you can’t deduct the entire cost of it on your income tax for that particular year. Instead, you use capital cost allowance to deduct a calculated portion of the expense as an income tax deduction and continue doing this over a period of years until the property or the equipment fully depreciates.

What many businesses are not aware of is that they don’t have to claim CCA in the year that it occurs. The CCA is not a mandatory tax deduction, so you can use as much or as little of your CCA claim in a particular tax year as you wish, and carry any unused portion forward to help offset a larger income tax bill in the future. It doesn’t make sense for you to take your full CCA claim deduction in a year that you have little or no taxable income.

Be aware, though, of the 50% rule: In the year that you acquire an asset, you usually can only claim 50% of the CCA that you would normally be able to claim. And in some cases, the “available for use” rule means that you can’t claim capital cost allowance until the second tax year after you acquired an asset.

Tax Deductions for Sole Proprietors Summary

Tax planning for sole proprietors is especially important due to the implications it could have on your business. As such it crucial to carefully plan for any upset using the tax deductions for sole proprietors discussed above.

Give us a call to see how you can organize your business books to maximize your tax refund.