Tax season is fast approaching and so is the stress of finding the right tax software, bookkeeper or accountant to file your taxes. In Canada, the process of filing taxes has improved a lot over the last 20 years. Prior to tax filing software, remember when people used to file tax returns by paper? Whew, gone are the days of paper filing your tax returns. And slowly but surely Canada is starting to phase out other outdated means of filing such as telephone filing.

With today’s technology, tax filing is easy than every especially with tax filing software. Many companies, with the help of the Canada Revenue Agency have implemented tax filing software that is simple and easy to use by anyone. The idea here is that filing taxes is ultimately your responsibility and shouldn’t be expensive or a headache.

Some of the software are completely free, others are paid and come with a few features. Each one comes with its own advantages and disadvantages.

Features of the Best Free Tax Software in Canada

So the question remains, what is the best free tax software to use in Canada? To answer this questions, there a few features that these software should have to even quality to help you file your taxes. Here are features of the best tax software for Canadians:

- CRA certified tax software – before filing your taxes with any software, make sure the software is certified by the CRA and uses CRA’s NETFILE web service NETFILE is an electronic tax-filing service that lets you do your personal taxes online and send your income tax and benefit return directly to the Canada Revenue Agency (CRA). Any tax software is required to be NETFILE certified before launch. This feature prevent any fraud or unlawful access to your personal information.

- File Prior Year Returns – the best free tax filing software should be able to file prior year returns. This feature is lacking in most free tax filing software due to the complexity of the ask.

- File Taxes for Multiple People – this feature is great if you want to file taxes for yourself and your family.

- Use CRA’s Auto-fill feature – this is great tool to file taxes quickly. The auto-fill feature allows the tax software to access your CRA account, pull relevant information, and complete the your tax return. Of course you still have to check the information to make sure it is accurate. But still it is a good feature to make sure that your information matches with CRAs.

- File Sole Proprietor Tax Returns – most free tax software will allow you to file basic returns, ie those without self employed business. But since the form to file for sole proprietors is part of your personal tax (T1), a good free tax software should include this feature.

Free tax software in Canada that have all the above feature, are the best tax filing softwares you can use. When accountants and tax filers are too expensive, try these free options..

In this article, we breakdown all the best free tax filing software to use in Canada. Let’s get started!

Best Free Online Tax Filing Software in Canada (Best Overall)

1) Wealthsimple Tax (SimpleTax)

Wealthsimple Tax (previously Simpletax) is the best overall free tax filing software in Canada. It is a CRA and Quebec Revenue certified software to file personal and sole proprietorship (self employed) tax returns. It has all the features you need to complete your return accurately including some additional features such as: a built-in refund optimizer, error checker, autofill function, and more. Wealthsimple Tax can be used to file returns for you and your family. Note that you are limited to filing up to 20 tax returns per account. Per CRA requirements, anyone filing more than 10 returns must register as an e-filer.

You can still file for previous returns (2012-2019) using SimpleTax (the original software). And if you filed with the software in the past, you can access your old returns from your account page.

The software is free to use for everyone but there are options to upgrade if you need support from someone.

Ratings:

File Prior Years:  (5.0 / 5)

(5.0 / 5)File for Multiple People:  (5.0 / 5)

(5.0 / 5)Ease of Use:  (4.0 / 5)

(4.0 / 5)For Sole Proprietors:  (5.0 / 5)

(5.0 / 5)

Features of Wealthsimple Tax

- Autofill return

- T2125 for Sole Proprietors

- E-file return – file online

- File for previous years

- Income tax calculator to plan for taxes

- State-of-the-art encryption to keep your data safe

- Two-factor authentication for added security

- Modern Interface

Pros and Cons of Wealthsimple Tax

| Pros | Cons |

|---|---|

| ✔️ File returns for multiple people | ❌ Can’t file corporate returns |

| ✔️ File prior year returns | ❌ No support unless you upgrade |

| ✔️ Auto-fill your return | |

| ✔️ File self employed return | |

| ✔️ Optimize returns for maximum refund |

How to file taxes free with Wealthsimple Tax

- Go to Wealthsimple Tax

- Click “Start your [Year] Return”

- Create A Login

- Complete the About You section

- Build Your Return using the search box

- Review your return and summary.

- Submit your return to CRA

Best Simple Online Tax Filing Software in Canada

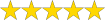

2) TurboTax

Turbotax has been the go to tax filing software for Canadian for years. It now utilizes an online software for Canadian to file taxes for free. Turbotax is credited by the CRA and is E-file certified which makes it an ideal solution to file your taxes for free. The free software allows you to file a basic tax return. Its is ideal for those who only have T4s for their tax return. It also supports income from CERB, CRB, CRCB, CRSB, CEWS, CERS, CESB, etc.

Turbotax has made the software as an app so you that you can easily access your tax returns via mobile.

Those looking for more complex returns can upgrade to other plans to unlock more features on the software. Another cool thing is that it allows you to file prior year returns for free!

If you looking for a simple solution to file your taxes, Turbotax is your best bet.

Ratings:

File Prior Years:  (4.0 / 5)

(4.0 / 5)File for Multiple People:  (1.0 / 5)

(1.0 / 5)Ease of Use:  (4.0 / 5)

(4.0 / 5)For Sole Proprietors:  (1.0 / 5)

(1.0 / 5)

Features of Turbotax

- File and submit taxes online

- Mobile app to view taxes

- Auto-fill return feature

- Automatic tax calculations

- File prior year returns free

- Online community forum

Pros and Cons of Turbotax

| Pros | Cons |

|---|---|

| ✔️ Easily import tax data with auto-fill | ❌ Online file 1 return for free |

| ✔️ Automatic tax calculations | ❌ Only limited to T4s for free versions |

| ✔️ Get access to previous returns with the same login | |

| ✔️ Affordable |

How to file taxes free with Turbotax

- Go to Turbotax.ca

- Pick a plan for your return

- Sign up for an account

- Complete the information about you

- Use the side panel and headers to find your slips

- Review the form

- Submit online to CRA

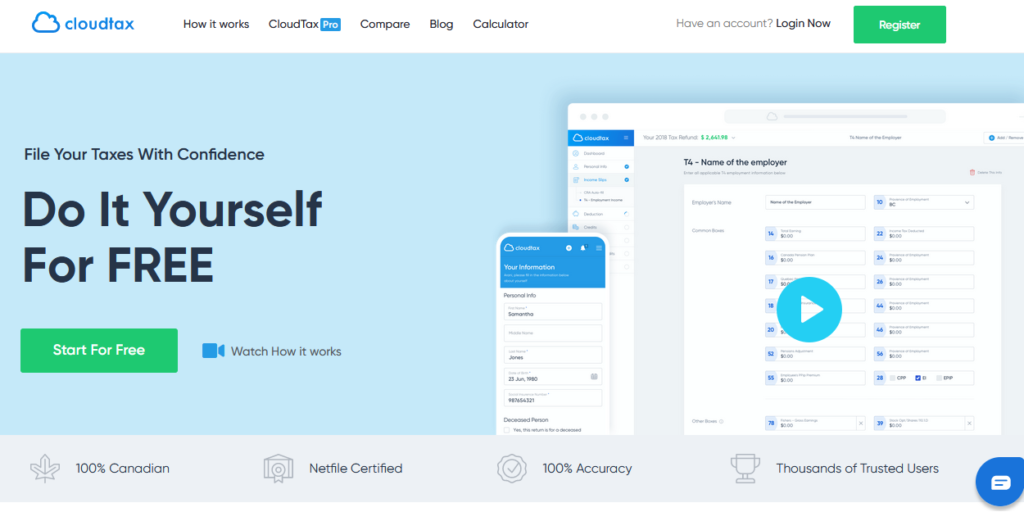

3) CloudTax

Cloudtax is an income tax filing platform, certified by the Canada Revenue Agency, that allows simple tax filers to file their taxes from home. Similar to Weathsimple Tax, it is made for any tax situation. Unlike other software however, CloudTax provides step-by-step guidance, unlimited chat support, and is compatible with Android mobile & iOS mobile/iPad.

Anyone can file their taxes for free – no excuses! CloudTax uses the highest privacy and security standards in the industry. Tax data is encrypted on their servers using a password key. Information is only shared with the CRA and only if you choose to NETFILE through CloudTax.

If you have a simple tax scenario, you can file your taxes for free. Unfortunately, you cannot use CloudTax Free if you reside in Yukon, Northwest Territories, Nunavut, or Quebec. In addition, CloudTax Free does not support self-employed, rental income holders, and employment expense reporters. There are upgradable options such as CloudTax Pro to get your taxes filed by a CloudTax Expert.

Ratings:

File Prior Years:  (4.0 / 5)

(4.0 / 5)File for Multiple People:  (1.0 / 5)

(1.0 / 5)Ease of Use:  (5.0 / 5)

(5.0 / 5)For Sole Proprietors:  (1.0 / 5)

(1.0 / 5)

Features of CloudTax

- Any tax situations

- Digital tax return storage

- View PDF prior to filing

- Auto-fill my return & Express NOA

- REFILE

- Unlimited chat support

- Step-by-step guidance

- Android mobile application

- iOS mobile & iPad application

- Audit protection

- Modern interface

Pros and Cons of CloudTax

| Pros | Cons |

| ✔️ File taxes using an app | ❌ Unavailable to residents in Yukon, Northwest Territories, Nunavut, or Quebec. |

| ✔️ Auto-fill your return | ❌ Cannot file self-employed, rental income, or employement expense returns |

| ✔️ Create milestones to monitor your project | ❌ File for yourself only |

| ✔️ REFILE previous returns | |

| ✔️ Chat supports if needed | |

| ✔️ File free prior year returns up to 3 years back |

How to use CloudTax to file tax returns for free

- Visit Cloudtax.ca

- Register for a free account

- Answers questions about yourself

- Use the Autofill function to prefill your return

- Review and submit your return

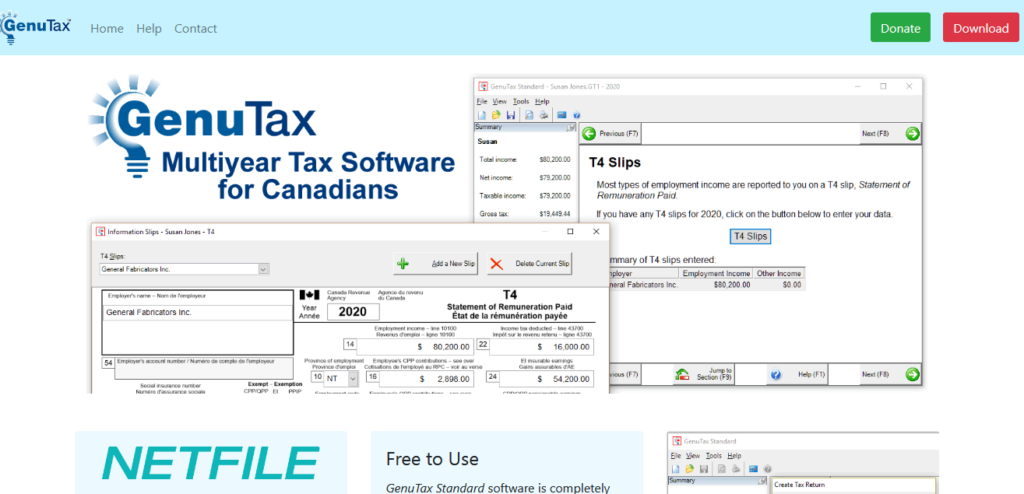

4) GenuTax

GenuTax is a completely free tax filing software for Canadians. Unlike the ones we mentioned above, GenuTax is a downloadable tax software. This means you have to download it onto your computer to use it. GenuTax supports only the Windows operating systems. Don’t be fooled by its outdated interface. GenuTax can handle most complicated tax situations.

With GenuTax, you get a A simple, easy-to-understand interview that takes you through your tax situation for each year, assisting you in claiming every tax deduction and credit that you are entitled to.

Users can file up to 20 tax returns without any income level limitations. Even though it is a downloadable software, the Autofill My Return function is also available for those that want to pre-fill their return.

Other features of the software include Express Notice of Assessment, where you can get your notice of assessment immediate after filing. The REFILE feature is also available if you need to change a tax return you have already filed.

GenuTax is definitely a go to tax software if you are looking for a tax software, that does just that, file your taxes.

Ratings:

File Prior Years:  (5.0 / 5)

(5.0 / 5)File for Multiple People:  (5.0 / 5)

(5.0 / 5)Ease of Use:  (4.0 / 5)

(4.0 / 5)For Sole Proprietors:  (5.0 / 5)

(5.0 / 5)

Features of GenuTax

- Auto-fill my return

- REFILE

- NETFILE

- Free

- Multiyear returns

- Express NOA

Pros and Cons of GenuTax

| Pros | Cons |

| ✔️ File prior year returns | ❌ unavailable for Mac users |

| ✔️ File self employed tax returns | ❌ Does not support form T1135 |

| ✔️ Easily import tax data with autofill | ❌ Does not support the Quebec provincial income tax return |

| ✔️ No need to sign up | |

| ✔️ Complete up to 20 returns per year |

How to use GenuTax to file tax returns for free

- Download GenuTax

- Complete the different sections of the return

- Review the return

- Submit the return to CRA using E-file

5) H&R Block

H&R Block has an online tax system that allows Canadians to file their own tax returns. This free online tax software allows you to handle all tax scenarios and give you the confidence to file with accuracy and security. The platform also provides expert help to those that need it. For a small fee, you have the option of choosing the Expert Review service to have an expert look over your completed return. Or our Ask a Tax Expert feature to get help while you file.

If you haven’t file taxes for sometime, the system allows you do so for with the prior year return feature as well. For those who are new to tax filing and want to try it for the first time, this is a great option. You can file your taxes confidently, knowing there is an expert available to help you at any time.

Ratings:

File Prior Years:  (5.0 / 5)

(5.0 / 5)File for Multiple People:  (5.0 / 5)

(5.0 / 5)Ease of Use:  (4.0 / 5)

(4.0 / 5)For Sole Proprietors:  (5.0 / 5)

(5.0 / 5)

Features of H&R Block

- Fill for all tax situations

- Automatic return optimization

- Personalized Guidance

- Online Help Centre

- Auto-Fill My Return (AFR)

- SmartSearch

Pros and Cons of H&R Block

| Pros | Cons |

| ✔️ File prior year returns | ❌ Fee for expert help |

| ✔️ Auto-fill return | |

| ✔️ REFILE return if you made a mistake | |

| ✔️ Chat supports if needed |

How to use H&R Block Online to file tax returns for free

- Visit H&R Block

- Register for a free account

- Answers questions about yourself

- Use the Autofill function to prefill your return

- Review and submit your return

Best Downloadable Tax Filing Software in Canada

6) TaxTron

TaxTron is another ax preparation software company in Canada that allows customers to prepare and file their tax returns as quickly and easily as possible.

With TaxTron, you can file your tax using the guided step-by-step method. Or, users can fill in the prescribed forms directly, for a variety of different users; individuals, professionals and corporations.

The platform is available on Windows, Mac and the Web.

Ratings:

File Prior Years:  (5.0 / 5)

(5.0 / 5)File for Multiple People:  (5.0 / 5)

(5.0 / 5)Ease of Use:  (4.0 / 5)

(4.0 / 5)For Sole Proprietors:  (5.0 / 5)

(5.0 / 5)

Features of TaxTron

- Step by step guide

- Assistance modules

- Video demonstrations on our application page

- Unlimited free support, via phone, email or live chat

Pros and Cons of TaxTron

| Pros | Cons |

|---|---|

| Pros | Cons |

| ✔️ Return’s are automatically saved online every minute | ❌ Can’t file prior returns |

| ✔️ Return can be filed from any location | ❌ No Auto-fill function |

| ✔️ Unlimited free support | |

| ✔️ Free to use software for certain income |

How to use TaxTron to file tax returns for free

- Visit TaxTron.ca

- Answers questions about yourself

- Use the Autofill function to prefill your return

- Review and submit your return

7) StudioTax

StudioTax is another certified tax filing software for Canadian. It is ideal for filing prior year returns for free. Unfortunately, there is a small charge of $15 for filing taxes for 2020 and beyond. The company still offers We are still offers the software for free for users with total income (line 15000) less than 20K and for our northern residents (NT, YT, NU). In this case you will not need a license or need to activate StudioTax 2020 in order to Netfile and print your returns. For $15, users can file up to 20 returns.

StudioTax works for Windows, Mac, iOS and Android. All versions have been approvaled by CRA for Netfile, ReFILE, printed returns, Auto-fill my return and Express Notice of assessment. T1135 is supported by the Windows and Mac versions. Quebec filers can also use this software for their returns as well.

Ratings:

File Prior Years:  (5.0 / 5)

(5.0 / 5)File for Multiple People:  (3.0 / 5)

(3.0 / 5)Ease of Use:  (3.0 / 5)

(3.0 / 5)For Sole Proprietors:  (4.0 / 5)

(4.0 / 5)

Features of StudioTax

- File for all tax situations

- Auto-Fill My Return (AFR)

- File anywhere with mobile apps

- File prior years

- REFILE

- Supports T1135

Pros and Cons of StudioTax

| Pros | Cons |

|---|---|

| Pros | Cons |

| ✔️ Return can be filed from any location | ❌ Full version is not free |

| ✔️ Free to low income earners | ❌ Outdated interface |

| ✔️ Supports all tax situations | |

| ✔️ Supports Quebec filers |

How to use StudioTax to file tax returns for free

- Visit Studiotax.com

- Download the software

- Purchase a license to use the full version

- Complete and review return

- submit return