Cash flow problems rarely show up all at once. They build quietly. It might start off with a few late clients here, a slow month there, one project you haven’t billed yet, and suddenly you’re staring at your bank account wondering how things got so tight.

If you’ve ever ran into this issue, the aging receivable report is one of the most practical tools your business can use to understand what’s actually going on.

However, many business owners either don’t know this report exists or don’t know how to interpret it. They see the columns, the dates, the numbers sitting in the 30, 60, 90-day buckets, and nothing makes sense. If that sounds familiar, this guide is for you.

My goal here is simple. I want to show you how to read an aging receivable report without needing an accounting background. Once you know what you’re looking at, the decisions you need to make become much easier. You’ll know which clients need attention, which invoices need fixing, and where your hidden cash flow problems are coming from.

Let’s break it all down.

What is an Aging Receivable Report

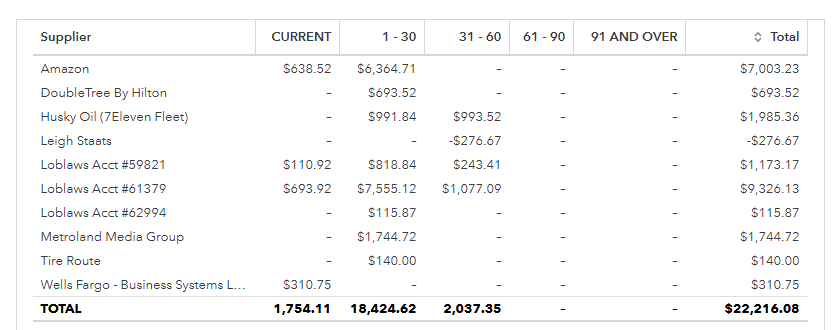

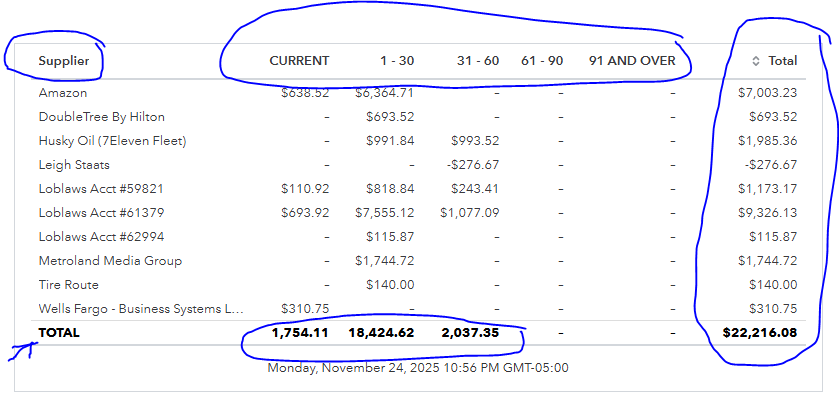

Think of an aging receivable report as a scoreboard showing what your clients owe you and how long they’ve owed it. Every unpaid invoice has a home on this report. Some sit in the Current section, meaning they aren’t past due yet. Others fall into 1 – 30 days overdue, 31 – 60, 61 – 90, and anything older than that.

The point isn’t to make the report look pretty. Rather, it is to give you a realistic snapshot of how healthy your accounts receivable are. If most of your invoices sit in the Current column, that’s good. It means clients are paying close to on time. If things are pooling in the 60–90+ column, that’s a warning sign, even if the total amount looks manageable. Those late invoices are disrupting your cash flow.

Every accounting system creates this report. QuickBooks, Xero, Wave, FreshBooks – doesn’t matter. The format might look a bit different, but the structure is the same because the job is the same. It shows you who owes you money, how much they owe, and how long they’ve taken to pay.

Once you understand that core purpose, all the columns start making sense.

How an Aging Report Is Structured

Before we walk through how to read it, let’s get familiar with the layout.

Each row usually represents a customer. Inside that row you’ll see details like the customer name, invoice numbers, invoice dates, due dates, and outstanding amounts. Then come the columns that matter most: Current, 1 – 30 days, 31 – 60 days, 61 – 90 days, and 90+ days. At the far right is the total amount that customer owes you.

If you zoom out a bit, you’ll notice the report also gives you totals for each aging bucket across your entire business. For example, it might show 18,000 in Current, 4,200 in 1–30, and 12,500 sitting in 90+.

Those numbers tell a story. They show whether your collection process is working, whether your customers respect your terms, whether you’ve been slow sending invoices, or whether something is breaking down in your workflow. The report doesn’t hide any of that. It’s all sitting right there. Your job is simply to learn how to read what it’s saying.

How to Read an Aging Receivable Report Step by Step

Let’s get into the part that most business owners never learn. Here’s how to make sense of the numbers and spot the real issues behind them.

1. Start with the total amount owing

This number is usually at the bottom. It’s the full amount of unpaid invoices. Don’t skip this. It’s the baseline you need for scale.

If you’re expecting stronger cash flow but the total number is high, that tells you the problem isn’t your sales. It’s your collections.

If the total number is low but cash still feels tight, that’s another story. You may not be invoicing enough, or you may be invoicing too late.

Either way, this number frames everything that follows.

2. Look at the distribution across aging buckets

This is where understanding starts to click. A healthy aging receivable report is front-loaded. Most of your money should be sitting in the Current column or the 1–30 bucket. That means clients are paying roughly within the timeframe you expect.

If you see a lot sitting in 61 – 90 or 90+, that’s not just “a pile of old invoices.” It’s a warning sign. Money sitting in those buckets becomes harder to collect the longer it sits. After 90 days, the odds of collecting in full drop significantly.

What this really means is that the aging receivable report doesn’t just show overdue invoices. It shows future cash flow problems before they hit.

3. Identify which customers owe the most

Not all late payments are equal. A client who owes you 200 and is 90 days late is annoying. A client who owes you 12,000 and is 90 days late is a real risk.

Look at the report from the perspective of concentration. If one customer represents a large portion of your total receivables, especially in the older buckets, they’re affecting your entire cash flow picture.

This isn’t about blaming them. It’s about knowing where to focus your follow-up. Some clients respond to a reminder within minutes. Others need more structure.

4. Examine the actual invoices inside the overdue buckets

The buckets tell you quantity. The invoices tell you quality. Sometimes overdue items aren’t even the client’s fault. It might be:

- an invoice sent to the wrong email

- a dispute you forgot about

- a deposit that never got applied

- a date-entry mistake

- terms that weren’t clear upfront

When you open the details, you usually find the cause quickly.

5. Look for patterns, not one-off issues

This is where you start getting insights, not just information.

Patterns matter. Some clients always pay late. Others pay early. Some only pay after two reminders. Some never open your email invoices unless you follow up with a call.

Look at the patterns. They tell you where your policies need tightening, where your workflow breaks down, and which clients might be quietly turning into liabilities.

6. Compare this month’s aging receivable report to the last few months

The best use of the aging receivable report is tracking change over time. Are your overdue amounts shrinking or growing? Perhaps certain clients drifting later and later? Are your total receivables increasing because you’re selling more, or because fewer people are paying?

Trend lines matter as much as the numbers.

7. Interpret what the report is telling you

Here’s the moment where everything comes together.

If your current bucket is strong, overdue amounts are small, and most clients pay on time, your systems are working.

If overdue amounts are growing month after month, especially in the older buckets, you have a process issue. It might be your invoicing schedule, your follow-ups, your payment terms, or your client mix.

When you learn to interpret the report, you can act before the cash flow problem hits.

How Aging Receivable Reports Improve Cash Flow

Cash flow doesn’t collapse overnight. It weakens in stages. The aging receivable report helps you see those stages clearly.

When you know exactly how much money is stuck in late invoices, you can predict what your next four to six weeks actually look like. Instead of hoping clients will pay, you can forecast based on their past behavior.

That’s the value here. The aging receivable report helps you plan. It helps you decide whether you should hold off on expenses, follow up on certain invoices, ask for deposits, adjust your terms, or shift your client strategy entirely.

This is why understanding this report matters. It isn’t about bookkeeping. It’s about making informed decisions that keep your business stable.

Common Red Flags That Deserve Attention

As you get comfortable reading your aging report, a few red flags start to stand out. These deserve more attention than they usually get.

Heavy amounts in the 60 – 90+ buckets

This usually points to one of three things: weak follow-up, unclear billing terms, or a client that can’t manage their own cash flow. None of these are problems you should ignore.

One client makes up most of your overdue receivables

Dependency on one slow-paying client puts your business at real risk. This is a strategic issue, not just a bookkeeping concern.

Same clients showing up late every month

Consistency is great when it’s positive, but a consistent late payer tells you the relationship needs to change. Maybe they need deposits. Or they need shorter project scopes. Perhaps they simply aren’t a good long-term client.

Sudden spikes in overdue invoices

This often signals an internal issue – invoices not being sent, follow-ups being missed, or bookkeeping mistakes.

When you catch these red flags early, they’re easy to fix. When you catch them late, they turn into cash flow emergencies.

Using Your Aging Receivable Report to Reduce Overdue Invoices

Once you understand the report, you can use it to improve your invoicing process and get paid faster.

Start with a consistent follow-up schedule. You’d be surprised how many invoices get paid simply because someone was reminded at the right time.

Then look at your invoicing habits. Are you billing late? Are your terms clear? Do you ask for deposits? Are you using payment reminders? Are you offering simple ways for clients to pay?

You don’t need to be aggressive. You just need to be consistent.

Sometimes the fix is as simple as a clearer contract or a better invoice template. Sometimes it’s adjusting expectations with clients who always push deadlines. And sometimes it’s recognizing that a client’s payment habits are telling you exactly how they value your work.

When you use the aging receivable report as your monthly check-in, overdue invoices stop sneaking up on you.

How a Bookkeeper Helps You Stay on Top of All This

You can absolutely learn how to read an aging receivable report yourself. But managing it every month, keeping invoices accurate, following up regularly, and catching errors before they snowball is a different job entirely.

That’s where a bookkeeper makes a real difference.

A good bookkeeper:

- keeps your data accurate

- generates clean aging receivable reports

- spots problems long before they hurt your cash flow

- builds a proper follow-up system

- helps you adjust your invoicing terms

- ensures overdue items don’t slip through the cracks

This isn’t about having someone “handle your books.” It’s about letting someone with experience protect your cash flow.

The reality is simple. Businesses with organized, consistent accounts receivable processes get paid faster. They stress less, plan better, and grow more predictably.

Dedicated Bookkeeping Team to help Your Growing Business.

Let’s Connect!

A Few Real Examples

A service business stuck with chronic late payers

They had more than 40% of their invoices sitting in the 60 – 90+ bucket. After reviewing the aging report, the issue became obvious: invoices were being sent sometimes two or three weeks late. Once we fixed the invoicing schedule and added reminders, overdue amounts dropped by more than half in two months.

A contractor who switched to deposits

His aging report showed one big client always sitting in the 60-day bucket. Not malicious, just disorganized. We changed the workflow to 50% upfront and the rest due at delivery. His cash flow stabilized immediately.

A freelancer dealing with bookkeeping errors

Her aging report was full of invoices that appeared overdue but weren’t. Duplicate entries, wrong dates, forgotten payments. Once the errors were cleaned up, she finally had an accurate picture. And it turned out her clients weren’t as late as she thought – her system was.

These situations are common. The solutions usually start with the aging report.

Monthly Aging Receivable Report Checklist

When you review your aging report each month, focus on a few key things.

- total outstanding receivables

- totals in each aging bucket

- clients with the largest overdue amounts

- repeat late payers

- invoices close to becoming overdue

- unusual changes from last month

- any errors or inconsistencies

This whole review should take about fifteen to twenty minutes once everything is organized.

If it takes much longer than that, your bookkeeping system probably needs a tune-up.

Final Thoughts

The aging receivable report is more than a spreadsheet. It’s a flashlight. It shows you where your money is stuck, why your cash flow feels tighter than it should, and what needs your attention. When you understand how to read it, you get a level of clarity most business owners never experience.

The truth is that most cash flow issues aren’t mysteries. They’re simply unmonitored patterns. The aging report is the easiest way to see those patterns and do something about them.

If you’re feeling overwhelmed by this process or if your aging report looks messy, confusing, or full of old invoices that never seem to change, I can help. Managing receivables is one of the most practical ways a bookkeeper can support your business. You don’t need complicated systems. You just need a clean process – and someone who knows how to keep it running.

If you want to get a handle on your aging report, your cash flow, or your invoicing workflow, reach out. A short conversation is usually all it takes to see where things can improve.

You run your business. I’ll help you get paid for it.